Ship design and future trends

The twenty-first century is generating a period of change and opportunity through a growth in new building and more emphasis on ship productivity.

It has renewed pressure on driving down both ship operating and ship building costs. Ship specification is a highly regulated industry through IMO regulations endorsed by maritime governments. Likewise the operation and maintenance survey of ships are highly regulated, as found in the ISM code (--470). The concept behind such a highly regulated environment is ship safety, which extends to the environment and cargoes conveyed.

There are three main factors affecting the technical feasibility and profitability of a ship. The deadweight/displacement ratio indicates the carrying capacity in relation to the total displacement. The deadweight is low for fast ferries with extensive passenger facilities. Container vessels have much higher deadweight/displacement ratios. The tankers and bulk carriers have the highest values. For all vessel types the deadweight/displacement improves with size.

The speed and power should also be judged in relation to the displacement.

For speeds below 20 knots, the power demand increases very slowly with increasing displacement. But at 35 or 40 knots the power curves become very steep. The third factor to observe is the lightweight density, which is an easy way to a first weight estimate for different ship types.

The ship functions can be divided into two main categories, payload function and ship function. In a cargo vessel the payload function consists of cargo spaces, cargo handling equipment and spaces needed for cargo treatment on board such as refrigeration equipment. The ship functions are related to carrying the payload safely from port to port. The areas and volume demanded in the ship to accommodate all systems are then calculated. The result is a complete system description for the new ship, including the volumes and areas needed onboard to fulfill the mission. This gives the total volume of the vessel and the gross tonnage can be calculated. Based on these data, a first estimate of weight and building costs can be made. The next step in the design process is to select main dimensions and define the form. By variation of the main dimensions the space and weight in the selected design is matched to the system description. The best dimensions are selected based on the performance and operation economies. Given below are the salient features in ship design.

(a) The salient factor is the broad specification outlined by the shipping company to the naval architect and shipbuilder, usually following a critical evaluation. It will feature the capital investment parameters, the return on capital, with special emphasis on revenue (cargo/passenger) production and related operating costs, the trade forecast and level of competition.

Innovation is a key factor in ship design. The international entrepreneur is very conscious ship investment is a risk business and the operational life may be beyond 25 years, during which period the profile of the trade and market conditions may change. Moreover, the older the vessel becomes the more costly it’s to maintain. This is due to the regulatory ship survey and maintenance code, which becomes more severe especially beyond the fifth survey.

(b) Market conditions and how best to respond to the needs of the shipper will be major factors in ship design, which will focus on raising standards for the merchant shipper in the form of overall faster transits and the continuing expansion of multi-modalism. The interface between the ship and berthing operations will be much improved thereby speeding up ship turn-round time. This involves quicker and more efficient transhipment techniques both for containerized traffic and the bulk carrier market.

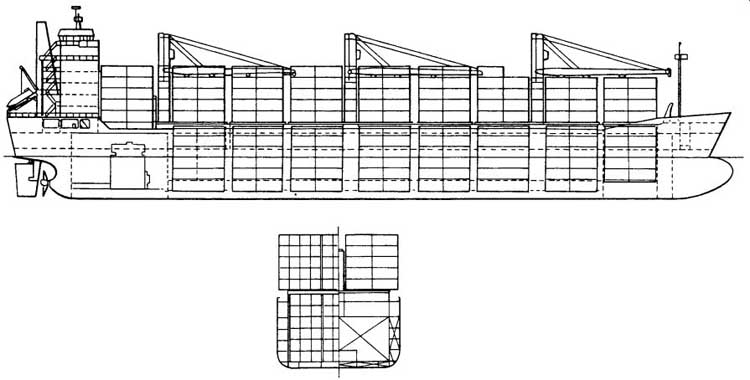

An example of the lengthened container ship technology demonstrating this point is found in Fgr. 4.

(c) The ship-owner will continue to extend shipboard efficiency with the aid of continuously improving onboard technology in all areas of operation.

The continuing expansion of the INMARSAT shipboard navigation/ communication technology is bringing in a new era of information technology and communications involving EDI (see Section 20) in the global maritime field.

(d) Ship safety will remain paramount, consistent with efficiency and the application of modern technology. The IMO is continuing to persuade member states of the need to adopt conventions to raise the safety of ships at sea. This involves especially ship design and specification.

(e) Ships are now subject to inspection by the registered state maritime agency whilst in port (), usually by accredited classification society surveyors or other designated surveyors, to ensure they are seaworthy.

Member states subscribing to the IMO Convention have legal powers to detain tonnage which fails to conform to the prescribed standards as found, for example, under MARPOL 90.

(f) Shipowners, as trade increases, are tending to replace tonnage by larger vessels rather than provide additional sailings. This lowers nautical tonne per mile costs but places more stress on planning and the total logistics operation at the berth. Accordingly container tonnage has now reached 10,000 TEUs and could attain 12,000 TEUs by the year 2010/12.

Likewise ferries operating in the cross-Channel and Baltic trades have much increased their capacity from 200 to 450 cars and/or the corresponding combination of road haulage vehicles. It results in vessels having a wider beam, increased length overall, but more especially more decks, increasing the ship freeboard. Such developments require extensive research to evolve/design such tonnage to comply with the strict IMO safety standards.

(g) More automation is now emerging in transhipment and docking arrangement.

(h) The development of the floating terminal and floating production, storage and offloading vessel is another example of innovation in ship design.

(i) Market research is used extensively to influence the interior design of cruise tonnage, both new build and refurbishment. Focus groups are employed from loyal cruise customers and potential ones.

(j) Design of the fast ferry must focus on turn-round time, speed and passenger interior décor. In order to attract passengers, a fast ferry must offer a service that the passenger perceives as 'value added'. Passengers will determine their acceptance of the ferry based on a variety of factors relating to comfort. In particular where passengers sit, dine, congregate and recreate will influence their passenger comfort and overall sense of well-being. The levels of vibration, noise, interior environment and lighting that passengers are exposed to will have either a positive or negative effect on these judgments. A second group of passengers will be influenced by vessel design, layout and seakeeping qualities. Factors such as pitching, rolling, slamming, excessive vibration and noise are not conducive to favorable ambient environmental conditions for the discerning passenger.

Ship productivity

Ship productivity is a key factor in ship design and its impact on ship operation.

We have already identified the new generation of electrical propulsion systems which will lower operation costs and provide more shipboard cargo and passenger capacity through the elimination of the shaft tunnel. More automation in cargo transhipment and docking arrangement all impact on ship design and quicker port turn-round times.

Operational productivity of the world fleet is an analysis of the balance between supply and demand for tonnage. Key indicators are the comparison of cargo generation and fleet ownership, tons of cargo carried and ton miles performed per deadweight ton and the analysis of tonnage over supply in the main shipping market sectors.

An analysis of Tbl. 1 provides indicative data on ton miles performed by oil tankers, dry bulk carriers, combined carriers and the residual world mercantile fleet. The thousands of ton miles per dwt of oil tankers increased in 2004 by less than 1% to 32.4, while the ton miles per deadweight ton of dry bulk carriers and combined carriers increased by 2.8% and 11.6% to 25.7 and 43.1 respectively. The residual fleet increased its productivity by 3.9% to 34.9 ton miles per deadweight ton.

The financier in the building cost analysis may use the cost of the dwt related to the cargo earning potential. The iron ore carrier building cost per dwt is much lower than the high-tech LNG tonnage. The container analysis would relate the TEU capacity with the building cost and the cruise liner on a berth basis. The mega container vessel and cruise liner exploit the economies of scale as the building cost per TEU and cabin falls as larger tonnage is built.

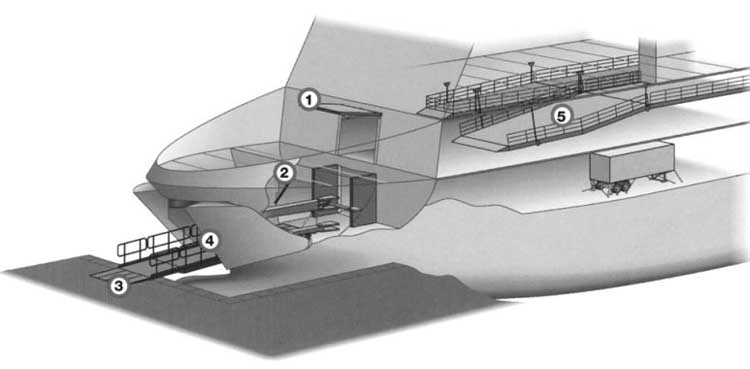

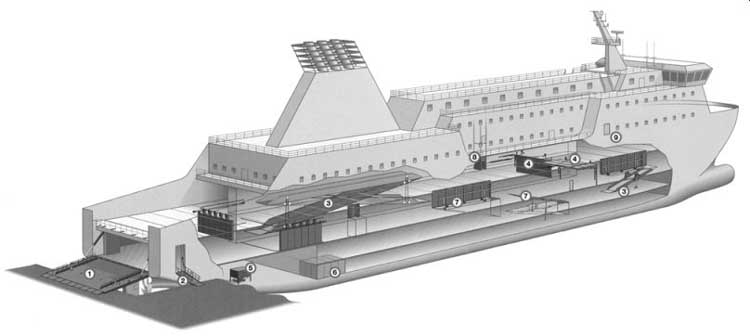

Ship productivity is realized through an efficient cargo flow ship to shore and vice versa. This ensures a quick port turn-round time at the port. Terminal layout is the key factor. Likewise passenger car/vehicular ferry ( Fgr. 7) must be customized in design to the trade and terminals. It illustrates the bow and stern loading arrangement.

Tbl. 1 Estimated productivity of tankers, bulk carriers, combined carriers and the residual fleet, selected years (000 of ton miles performed per dwt)

Fgr. 1a Efficient cargo flow on a passenger/vehicle ferry (a) bow section:

1 front door, 2 inner bow door, 3 bow ramp/door, 4 bow doors, 5 hoistable car

deck. (MacGregor Group AB, Stockholm)

Fgr. 1b Efficient cargo flow on a passenger/vehicle ferry (b) stern view:

1 straight stem ramp/door, 2 side ramp/door, 3 hoistable ramps, 4 flood control

doors, 5 hydraulic power pack, 6 provision stores, 7 ramp cover, 8 elevators,

9 side doors. (MacGregor Group AB, Stockholm)

General principles and factors influencing design, type and size of ship

In his choice of the type of ship to be built, the ship-owner must consider primarily the trade in which she is to operate. His decision as to size and propelling machinery will be governed by the factors involved in his particular trade, such as the nature of the cargo mix to be moved, the cost and availability of fuel, the minimum carrying capacity required, the length and duration of the voyages and the required speed. Economic, technical, statutory and safety considerations will all influence his choice.

So far as the building and operating costs are concerned, within certain limits, the larger ship is a cheaper proposition. For example, the cost of the propelling machinery for a 100,000 tonner is less than the cost for two 50,000 tonners developing the same power. The larger ship costs less to crew than two smaller ships and its operating costs per ton are lower. In the bulk trades, where the nature of the cargo calls for large roomy holds, the economics of size alone favor the employment of large ships. However, increased size implies deeper draught, and if a general trader is to be operated economically, she must be able to proceed anywhere where cargo is offered.

On one voyage she may be going to Mumbai which permits vessels with a maximum draught of 16 m, while its next employment may be in the River Plate where the draught is limited to about 9 m. She may have to load from an ore jetty off the coast of Chile where safety considerations prohibit the large ship. All these considerations have to be balanced, and today the modern tramp has developed into a handy-size vessel for dry bulk cargo: Handysize 20,000-35,000 dwt, Handymax 35,000-50,000 dwt, Panamax 50,000-80,000 dwt and Capesize 80,000-150,000 dwt. The speed is 14-16 knots and all are capable of passing through the Panama Canal except the Capesize. The Handymax operates in the Far East and Pacific regions carrying timber and many are family-owned. The Panamax conveys coal/grain between North America to the Far East/Middle East. The Capesize, the most economical per dwt, conveys iron ore and coal between Australia to Japan, China and Brazil to Europe/Far East.

Recently the cellular container ship has featured more prominently in cargo liner trades. Additionally, more purpose-built tonnage is becoming available for carrying such products as liquefied methane, trade cars, etc.

Such ships - often owned or on charter to industrial users - are designed for a particular cargo and are frequently involved in a ballast run for part of the round voyage. Purpose-built tonnage requires special terminals - often situated away from the general port area - frequently involving expensive equipment to ensure quick transhipment. As we progress through the early years of the twenty-first century we are experiencing a growth in container tonnage which is driving a logistic environment causing many shippers to review their break bulk shipments and bulk cargo shipments, especially fruit and cement carriers. This has been facilitated by 'on going' modernization of container terminals. Moreover, the demise of the mammoth oil tanker of 500,000 dwt - the ultra-large crude carrier of 29 m draught - is due to the very limited number of ports of call it may operate, owing to its size. The draught is too deep for some shipping lanes. A further factor is the diminishing number of trades which can support a vessel of such size other than on a multi-port operation, which is uneconomical. The ore/bulk/oil OBO continues to fall, representing less than 1% of the world fleet. This is due to the high maintenance cost and absence of trades to support such tonnage. No new builds are predicted, which is especially due to high capital costs. The student must study closely the world merchant fleet composition profile and factors driving change. The changing pattern of trade and emerging trends plays a significant role in new investment and employment of tonnage. The era of multi-purpose tonnage still remains where trade situations demand.

Where the vessel to be constructed is intended for long-term charter to industrial users, as in the case of many oil tankers, ore carriers and other specialized cargo ships, the limits of size are dictated by terminal facilities or by obstacles of the voyage - such as arise, for example, in the Panama Canal or St Lawrence Seaway (see p. 126).

Much of the foregoing analysis applies equally to cargo liners, except that flexibility of operation is not so important. A factor tending more to limit their size is the importance of providing frequent sailings which the market can support. The overseas buyer pays for his goods when the seller can produce bills of lading showing that the consignment has been shipped. Under such conditions the merchant demands frequent sailings, and if the ship-owner does not provide them his competitors will! Today the container line operator is continuously remodeling their services through larger vessels (--64) on core routes to serve hub ports and feeder vessels operating the hub and spoke system. This is driven by logistics and ongoing container terminal modernization. Container tonnage is growing at 8% per year.

Safety and other regulations

Associated with the provision of new tonnage, there is the obligation to comply with statutory regulations, classification society rules and international agreements affecting ship design, and these vary according to the requirements of the different flags, particularly in matters relating to accommodation.

Vessels registered in the UK have to be built to the statutory requirements imposed by the Department of Transport, Local Government and the Regions.

The regulations concern all life-saving apparatus, navigational aids, the hull and machinery, crew and passenger accommodation, water-tight and fireproof bulkheads, gangways, emergency escapes, anchor cable and hawsers, shell plating, ship inspection at the seaport, etc. The basis of these requirements is included in the Merchant Shipping Act of 1894. Various amendments and additions to these regulations have reached the statute guide to meet new conditions and developments. These are found in the IMO Conventions on Maritime Safety, which include the International Convention on the Safety of Life at Sea (SOLAS) 1960 and 1974 and entered into force in 1980. It specifies minimum standards for the construction, equipment and operation of ships compatible with safety. It has been amended several times, including twice in 1978 and 1988 by means of Protocol (--33). A significant one which entered into force in July 2004 was measures to enhance maritime security embracing the International Ship and Port Facility Security Code (--214). Also mandatory provision is made from December 2004 for installation of automatic information, systems and continuous synopsis records to provide 'on board' records of the history of the ship. Other IMO conventions are the International Convention on Load Lines 1966, the Special Trade Passenger Ship Agreement 1973, the Convention on the International Maritime Satellite Organization (INMARSAT) 1976, the International Convention on Standards of Training, Certification and Watchkeeping for Seafarers (STCW) 1978 and the International Convention on Maritime Search and Research (SAR) 1979.

All the foregoing have been subject to amendment and protocol as recorded.

Statutory regulations

International conventions, codes and protocols concerning ship safety and marine pollution are agreed by the member states of the United Nations Agency, the International Maritime Organization (IMO). In the past 50 years IMO has promoted the adoption of some 35 conventions and protocols and adopted numerous codes and recommendations. The conventions and codes usually stipulate inspection and the issuance of certificates as part of enforcement. Most member countries and/or their registered shipowners authorize classification societies to undertake the inspection and certification on their behalf. For example more than 100 member states have authorized Lloyd's Register to undertake such inspection and certification.

IMO conventions define minimum standards but member states can instigate national regulations which incorporate IMO standards and apply equally well to their own fleets and visiting foreign ships. Classification societies participate in the work of the IMO as technical advisers to various delegations.

Their key function is to provide inspection and certification for compliance and advice on these complex regulations. Various aspects of the IMO conventions are dealt with elsewhere in the guide.

Given below are a selection of statutory marine surveys:

(a) Load Line Certificate. An international load line certificate is required by any vessel engaged in international voyages except warships, ships of less than 24 m in length, pleasure yachts not engaged in trade and fishing vessels. It’s valid five years, with an annual survey.

(b) Cargo Ship Safety Construction Certificate. This is required by any ship engaged in international voyages except for passenger ships, warships and troop ships, cargo ships of less than 500 gross tonnage, ships not propelled by mechanical means, wooden ships of primitive build, pleasure yachts not engaged in trade and fishing vessels. Survey classification ensures the SOLAS 1974 convention is complied with in the areas of hull, machinery and other relevant equipment. For vessels of 100 m length and over, compliance with damage stability requirements is also required. It’s valid for five years, with an annual survey.

(c) Cargo Ship Safety Equipment Certificate. This is required by any ship engaged on international voyages except for the ship types detailed in item (b). Survey classification ensures the SOLAS 1974 convention Sections II-1, II-2, III and IV are complied with along with other relevant requirements. It’s valid for two to five years, with an annual survey.

(d) Cargo Ship Safety Radio Certificate. This is required by all cargo ships of 300 gross tonnage and upwards on international voyages, which are required to carry equipment designed to improve the chances of rescue following an accident including satellite emergency position indicating radio beacons (EPIRBS) and search and rescue transponders (SARTS) for the location of the ship or survival craft. It features under the current SOLAS Convention Section IV, Radio Communications, which was completely revised in 1988 and amendments introduced from February 1999 and embraced the GMDSS. By that date the Morse Code was phased out. Section IV is closely linked with the Radio Regulations of the International Telecommunications Union.

(e) Passenger Ship Safety Certificate. This is required by any passenger ship under SOLAS Regulation 12(a)(vii) engaged on international voyages except troop ships. A passenger ship is a vessel which carries more than 12 passengers. Pleasure yachts not engaged in trade don’t require a Passenger Ship Safety Certificate following compliance with the requirements of the 1974 SOLAS Convention. This includes the survey arrangements for subdivision, damage stability, fire safety, life-saving appliances, radio equipment and navigational aids. It’s reviewed annually following:

(f) International Oil Pollution Prevention Certificate (IPPC). It’s valid for five years with an annual survey.

(g) Document of compliance (DOC). Mandatory under the ISM code and valid for five years with intermediate surveys.

(h) Carriage of dangerous goods. SOLAS 1974 as amended featured 12 sections in an annex embracing Section VII, termed Carriage of Dangerous Goods. It features three parts: Part A, Carriage of dangerous goods in packaged form or in solid form or in bulk. It embraces the International Maritime Dangerous Goods (IMDG) code. A new code was adopted in May 2002 and mandatory from 1 January 2004.

Part B, Construction and Equipment of Ships carrying Dangerous Liquid Chemicals in Bulk, requires chemical tankers built after July 1986 to comply with the International Bulk Chemical Code (IBC Code). Part C embraces the construction and equipment of ships carrying liquefied gases in bulk and gas carriers constructed after July 1986 to comply with the requirements of the International Gas Carrier Code (IGC Code).

Two examples are found in the IBC and IGC codes. The IMO international code for the construction and equipment of ships carrying dangerous chemicals in bulk (IBC code) provides safety standards for the design, construction, equipment and operation of ships carrying dangerous chemicals. An additional code - the BCH - is applicable to existing ships built before 1 July 1986.

A document/certificate termed a Certificate of Fitness is issued by the classification society in accordance with the provisions of the IBC or BCM code and is mandatory under the terms of either the 1983 amendments to SOLAS 1974 or MARPOL 73/78. For national flag administrations not signatory to SOLAS 1974, a statement of compliance would be issued by the classification society in accordance with a ship owner’s request.

The other example is found in the IMO international code for the construction and equipment of ships carrying liquefied gases in bulk (IGC code).

This requires that the design, constructional features and equipment of new ships minimize the risk to the ship, its crew and the environment. There are additional gas carrier codes applicable to existing ships built before 1 July 1986. A Certificate of Fitness is mandatory under the terms of the 1983 amendments to SOLAS. For national flag administrations not signatory to SOLAS 1974 a statement of compliance would be issued by the classification society in accordance with a ship owner’s request.

(a) International Safety Management Code

In 1993 the International Safety Management (ISM) Code was completed by the IMO. The objectives of the code are to ensure safety at sea, the prevention of human injury or loss of life, and the avoidance of damage to the environment (in particular the marine environment) and property. The functional requirements for a safety management system to achieve these objectives are as follows:

(a) a safety and environmental protection policy;

(b) instructions and procedures to ensure safe operation of ships and protection of the environment;

(c) defined levels of authority and lines of communication between and amongst shore and shipboard personnel;

(d) procedures for reporting accidents and non-conformities within the provisions of the code;

(e) emergency response procedures;

(f) procedures for internal audits and management reviews.

The code effectively supersedes the guidelines in Management for the Safe Operation of Ships and for Pollution Prevention adopted by the IMO Assembly in 1991. The new Section IX makes the ISM code mandatory and adopted by the IMO assembly in November 1993 (Assembly resolution A.741(18)).

Until 2002 the ISM was mandatory under SOLAS for passenger ships (including high speed craft), oil tankers, chemical tankers, gas carriers, bulk carriers and cargo high speed craft of 500 gross tonnage and upwards. From July 2002 it was mandatory for other cargo ships and mobile offshore drilling units of 500 gross tonnage and upwards. To coincide with the extension of the range of ships to which the application of the ISM Code is mandatory, it was necessary to amend Section IX of SOLAS 1974 and to the ISM code.

It has resulted into Revised Guidelines on the implementation of the code.

The code establishes the following safety management objectives: (a) to provide for safe practices in ships operation and a safe working environment;

(b) to establish safeguards against all identified risks; and (c) to continuously improve safety management skills of personnel, including preparing for emergencies.

The code requires a safety management system (SMS) to be established by 'the Company' which is defined as the ship-owner or any person, such as the manager or bareboat charterer who has assumed responsibility for operating the ship. The Company is then required to establish and implement a policy for achieving these objectives. This includes providing the necessary resources and shore based support. Every Company is expected to 'designate a person or persons ashore having direct access to the highest level of management'. The procedures required by the code must be documented and compiled in a Safety Management Manual, a copy of which should be kept on board.

The scheme for certification to the International Safety Management Code (ISM Code) is a means to demonstrate a shipping company's commitment to the safety of its vessels, cargo, passengers and crew, and to the protection of the environment, in compliance with the ISM Code. Overall it provides for the assessment of a company's safety management systems on board vessels, and as required in shore-based offices. It requires each ship in a company fleet as well as the company's shore-based management systems to be separately certificated. The scheme lays down the assessment procedures which will be followed when either the shipboard systems or the shore-based systems or both are to be assessed for certification, which is usually undertaken by an accredited classification society such as Lloyd's Register. The assessment confirms company policy and central measures in accordance with the ISM Code.

Certification in accordance with the requirements of this scheme should not be taken as an indication that the company or its vessels comply with international or national statutory requirements other than the ISM Code and it does not endorse the technical adequacy of individual operating procedures or of the vessels managed by the company. Overall the certificate will confirm the following:

(a) An appropriate management system has been defined by the company for dealing with safety and pollution prevention on board.

(b) The system is understood and implemented by those responsible for the various functions.

(c) As far as periodic assessments can determine, the key actions indicated in the system are being carried out.

(d) The records are available to demonstrate the effective implementation of the system.

The scheme does not in any way replace or substitute class surveys of any kind whatsoever.

(b) Application for certificate The company's application for certification to the IACS Society (--132) and the relevant information must include the size and total number of each ship type covered by the SMS and any other documentation considered necessary.

Initial verification

The initial verification for issuing a DOC to a company consists of the following steps:

(i) Document review. In order to verify that the SMS and any relevant documentation comply with the requirements of ISM Code, the auditor is to review the safety management manual. If this review reveals that the system is not adequate, the audit may have to be delayed until the company undertakes corrective action. Amendments made to the system documentation to correct deficiencies identified during this review may be verified remotely or during the subsequent implementation audit described in (ii) below.

(ii) Company audit. In order to verify the effective functioning of the SMS, including objective evidence that the Company's SMS has been in operation for at least three months, and at least three months on board at least one ship of each type operated by the Company. The objective evidence is to inter alia, include records from the internal audits performed by the Company, ashore and onboard, examining and verifying the correctness of the statutory and classification records for at least one ship of each type operation by the Company.

The initial verification for issuing a SMC to a ship consists of the following steps:

(i) Verification that the Company DOC is valid and relevant to that type of ship, and that the other provisions are complied with. Only after onboard confirmation of the existence of a valid DOC can the verification proceed; and (ii) Verification of the effective functioning of the SMS, including objective evidence that the SMS has been in operation for at least three months onboard the ship. The objective evidence should also include records from the internal audits performed by the company.

If the company already has a valid DOC issued by another IACS Society, that DOC shall be accepted as evidence of compliance with the ISM Code, unless there is evidence indicating otherwise.

Periodic verification

Periodical safety management audits are to be carried out to maintain the validity of the DOC and/or SMC. The purpose of these audits is, inter alia, to verify: (i) the effective functioning of the SMS; (ii) that possible modifications of the SMS comply with the requirements of the ISM Code;

(iii) that corrective action has been implemented; and (iv) that statutory and classification certificates are valid, and no surveys are overdue.

Verification of the statutory and classification certificates is to be carried out on at least one ship of each type identified on the DOC. Periodical verification is to be carried out within three months before and after the anniversary date of the DOC. Intermediate verification is to take place between the second and third anniversary date of the SMC.

Renewal verification:

A DOC and/or SMC renewal verification shall be carried out from six months before the expiry date of the certificate and shall be completed before the expiry date. DOC and/or SMC renewal verification shall be carried out according to the same principles detailed above for the initial verification, including all elements of the SMS and the effectiveness of the SMS in meeting the requirements of the ISM Code. Document review shall be part of the renewal verification if modifications to the Company and/or shipboard SMS have taken place.

Two key documents exist with the ISM Code - the Safety Management Certificate (SMC) and the Document of Compliance (DOC). The DOC is issued by an accredited Ship Classification Society listed by IACS and valid for five years subject to periodical annual verification that the Safety Management System complies with the ISM code. The SMS is issued by another accredited Ship Classification Society that it complies with the ISM code following the annual periodical review inherent in the DOC annual renewal, maintenance compliance with IMO resolution A739(18) and all statutory certificates are valid. It’s valid for five years, with at least one intermediate verification.

Associated with the ISPS code vessels must carry the International Ship Security Certificate to confirm full compliance with the code which embraces other ship board mandatory facilities.

Survey methods

The traditional way of surveying a vessel was to bring it to a shipyard where items to be surveyed were opened up, cleaned, inspected and reassembled.

This method is both time-consuming and expensive, but is still practiced widely for a variety of reasons. However, a number of alternative survey methods exist today which have been developed by the classification societies and are now very popular. Details are given below:

(a) Voyage survey:

The surveyor is in attendance during the ship's voyage, and carries out the required surveys. If requested, he prepares specifications in co-operation with the owner on items to be repaired.

(b) BIS notation:

Although docking a vessel is still necessary for a number of reasons, the interval between dockings has been increased considerably. This extended interval may come into conflict with the 'normal' class rules. However, by arranging minor modifications to the hull and its appendages, a notation 'bis' (built for in-water surveys) may be obtained which allows a docking interval of five years.

(c) Continuous survey:

Classification Rules require that the surveys of hull and machinery are carried out every four years. Alternatively continuous survey systems are carried out, whereby the surveys are divided into separate items for inspection during a five-year cycle. For the machinery survey the rules provide that certain of these items may be surveyed by the chief engineer. Furthermore, for vessels carrying out machinery maintenance in accordance with a fixed maintenance schedule, this system may replace the continuous machinery survey system, thereby reducing the class survey to an annual survey.

(d) Planned maintenance system:

This is subject to a form of approval and may thereafter be used as a basis for a special survey arrangement for individual ships at the owner's request.

Today, most cost-conscious shipowners operate advanced planning systems and maintenance procedures in order to meet increasing demand for cost effective operation.

To avoid unnecessary opening up of machinery and duplication of work, many classification societies have introduced an alternative survey arrangement for the machinery. The arrangement is based on the owner's planned maintenance system already in operation 'on board'. It involves the following sequence of survey program.

(a) classification society approves the owner's maintenance program;

(b) initial survey on board by classification society surveyor;

(c) continuous machinery survey to be in operation;

(d) chief engineer to be approved by classification society.

The annual survey inspections carried out by the chief engineer are accepted as class surveys. However, the annual audit survey must be carried out in conjunction with the ordinary annual general survey (AGS). The audit survey is to verify that the arrangement meets agreed procedures. At the annual audit survey, the surveyor reports the class items requested by the owner.

A summary of the business benefits embraces (a) builds on a ship-owner investment budget in planned maintenance; (b) contributes to reduced risk in ship operation through breakdown etc.; (c) enables the ship-owner to demonstrate through the ISM code total commitment to quality ship management; (d) contributes to the ship-owner objective to maximize revenue potential through ship availability and productivity; and (e) contributes to reduction in operation costs. Overall, it helps to avoid unnecessary off-hire time, chartering needs/costs, and duplication of ship inspection, thereby overall contributing to improved revenue production/profit potential, less risk of disruption of service and much improved ship management.

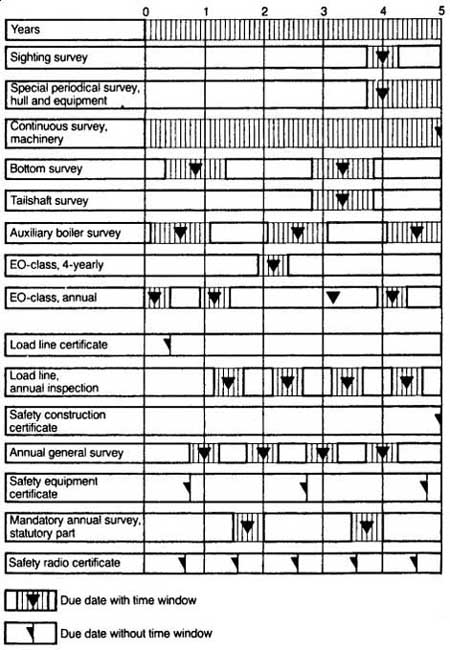

Harmonization of surveys

The conventions require an initial survey before a vessel is put in service for the first time and then receives its first certificate, and a certificate renewal survey at one, two or five year intervals thereafter, depending on the certificate and type of ship. In addition, for those certificates valid for more than one year, surveys at annual intervals are required, one of which, at approximately half way and termed 'intermediate', may be of greater extent than an ordinary 'annual'. In February 2000, under amendments to SOLAS 1974 through the 1988 Protocol, a new harmonized system of surveys and certification was introduced which will harmonize with load lines and MARPOL 73/74. The 'Harmonized System of Survey and Certification' (HSSC), implemented by many administrations under IMO resolutions A.746(18) and A.882(21), brings all SOLAS (except for passenger ships), MARPOL and Load Line Convention surveys into a five-year cycle. With respect to safety equipment surveys, HSSC uses the term 'periodical' instead of renewal surveys held under the shorter certificate renewal cycles.

The scope of surveys can generally be harmonized with the extents of the classification surveys detailed above and, as far as possible, are held concurrently with them.

The scope of surveys, which does not necessarily encompass 100% of the structure, equipment, etc., of the ship, is laid down by IMO resolutions and generally increases with age. It’s to include sufficient extensive examinations and checks to show that the structures, main and essential auxiliary machinery, systems and equipment of the ship are in a satisfactory condition and are fit for the service for which the ship is intended in so far as the requirements concerned are met.

Between surveys, the conventions require the flag administration to make it compulsory for the owner to maintain the ship to conform to the regulations to ensure that the ship will in all respects remain fit to proceed to sea without danger to the ship or persons on board or unreasonable threat of harm to the marine environment.

The core objective in regular survey programs is to realize the highest standards of ship safety. The IMO are very conscious of this objective and through their committee mechanism - primarily Maritime Safety Committee - regularly review the situation in the light of new marine engineering technology; GMDSS; ISM code; accidents and the latest generation of new build. Examples emerging from SOLAS 1974 include new provisions emerging from the Herald of Free Enterprise disaster featuring ship stability, Section II-1, entry into force 1990; grain shipments, Section VI; cargo stowage, entry into force January 1994; sinking of Estonia featuring new stability for ro/ro passenger ships, Sections II-1, III, IV, V, VI, entry into force July 1997; high speed craft code 2000, entry into force July 2002; a new generation of high speed craft; Sections II-1 and XII, embracing new safety measures for construction; and safety focus on bulk carriers, entry into force July 2004.

Finally, with reference to Fgr. 3.2, we will now focus on some of the various types of survey: (a) the class renewal surveys/special surveys are carried out at five year intervals - it includes extensive examination to check that the hull structures, main and essential auxiliary machinery, systems and equipment of the ship remain in a condition to which satisfies the ship classification rules; (b) the annual survey must be carried out from three months before to three months after each anniversary date - the ship is generally examined and includes inspection of the hull, equipment and machinery; (c) an intermediate survey must be carried out within the window from three months before the second to three months after the third anniversary date;

(d) bottom/docking survey is the examination of the outside of the ship's hull and related items; (e) the tail shaft survey is the survey of screw shafts and tube shafts; (f) a partial survey allows a postponement of the complete survey, having a periodicity of five years for two and a half years; (g) and non-periodical surveys are carried out at a time of port state control inspections, to update classification documents following change of owner, flag, name of ship, or to deal with damage, repair/renewal, conversion or postponement of surveys.

Fgr. 2 Non-harmonized ship survey program. (Det Norske Veritas)

Vessel lengthening

The operational life cycle of a vessel will vary by ship type and throughout this period the economics of the investment changes. Vessels are tending to be of higher capacity and more high-tech. This involves a refit, may be engine transplant, refurbishment, new technology, and in some cases lengthening to take advantage of deeper draught and/or increase maximum permitted length as obtains on the Panama Canal (--123). An example of increasing ship capacity has arisen in the cruising fleet of Royal Caribbean.

Overall, five cruise vessels are scheduled for lengthening, three of which to date have been completed - the Song of Norway in 1978, the Nordic Prince in 1980 and the Enchantment in 2005.

The Enchantment was lengthened 22 m to give an overall length of 301-4 m and provides 151 additional cabins, increasing the passenger certificate to 2,730. It will result in a marginal increase in crew and likewise fuel consumption. The vessel comprises various public spaces such as a specialty restaurant, fitness rooms, conference room, a coffee shop and ice cream parlor. On deck various luxurious jacuzzis have been constructed together with a row of trampolines.

The specialist shipyard in Holland, Keppel Verolme, cut the vessel in two and inserted a mid-section between the two halves of the vessel. It took five weeks to undertake this phase of the work in dry dock at Botlekhaven. The task demanded high engineering skills and involved 1,100 cables, 120 pipes and 60 air ducts to cut, together with 600 m of heavy steel plate. Two days after this operation the new mid-section was positioned. It was constructed at the Keppel Verolme shipyard where the Enchantment was launched in 1997. The new mid-section was moved to Rotterdam on a special transport pontoon of sea towage company Smit and positioned next to the dry docked ship using eight hydraulic hoists. A specially developed skid system - a form of slide - was used to insert the new mid-section. The ship itself was placed on a similar construction. Following completion of the cutting, the bow segment could be slid forward. Powerful screw jacks were used to move this part of the ship that weighed in excess of 10,000 tonnes. After the new section had been correctly placed - an operation which took two hours - screw jacks were used to push the parts back together until they touched again.

Tensions in the hull of the ship caused a deviation of about 6 cm at the top of the different segments. Work then progressed to weld together the parts from the bottom. In this way the top parts became neatly pressed together again. The welding together of the bow part and afterdeck of the mid-section proved an intensive operation: the welders worked day and night for the twenty-four hour periods to reassemble the ship's hull.

The benefits of having a mid-section installed in a vessel include: prolonged life of the vessel; increased capacity, exploit economies of scale through crew complement, bunker and increased reight/passenger revenue; increases voyage profitability, more competitive tonnage, less capital expenditure to lengthen vessel than build a replacement; time scale much quicker, as vessel conversion takes weeks and not two or three years for new tonnage; vessel pay-back much earlier, as ship starts to earn revenue following conversion; ship capacity can take advantage of enlarged facilities such as Panamax tonnage; vessel turn-round time in port can be improved through new technology; and finally, brand image of converted tonnage strengthens the market appeal of new business. Study Fgr. 5.

Cruise vessels

The growth of the cruise market in the past decade has been dramatic and in 2004 reached 10.5 million people. This has been due to a number of factors: the decline in the package holiday market; the enormous growth in new cruise tonnage, especially vessels above 2,000 passenger capacity, permitting the economies of scale; a new era of cruise ship design with focus on all age groups, especially younger people and families; the development of the fly cruise market; the increasing consumer wealth, especially in developed countries, stimulating global travel; and the continuous expansion of the cruise itineraries.

The cruise market falls into the following divisions: Mediterranean, Caribbean, Atlantic Isles, Scandinavia/Baltic; North America, round the world cruises, and river cruises, especially in Europe. Over 40 cruise lines exist, embracing Carnival Cruise Line, Cunard Line, Mediterranean Shipping Cruises, Royal Caribbean International, P&O Cruises and Swan Hellenic.

The North American and Mediterranean markets are the largest.

Carnival Cruise Line in 2005 launched its latest cruise vessel called Carnival Liberty. The 110,000 GT vessel was built in 24 months and is 290 m long and 38 m wide with 2,121 cabins and passenger capacity of 3,710 and crew of 1,182. It has a cruising speed of 20 knots and has a 1,500 seat theatre, five swimming pools, four restaurants and 22 bars. Carnival Cruise Line has a further nine more vessels on order for completion in 2008. A new generation of cruise tonnage will emerge with the post-Panamax ship currently under construction for Celebrity Cruises. The vessel is 117,000 GT and has a passenger capacity of 2,850 passengers. The cost is US$640 million, involving a berth price of US$225,000. The width of the ship is 36.8 m and length 315 m. It’s the first wide body construction ship for Celebrity Cruises and 90% of the outside cabins have balconies. The ship is equipped with pod propulsion and diesel engines (--18), having a combined output of 91,400 hp. The vessel will be launched in autumn 2008. Carnival Cruise Line is a subsidiary of Royal Caribbean.

Cruise operators are very conscious of keeping pace with the new generation of cruise tonnage and tend to replace the main engines with more efficient propulsion and also engage in a complete refurbishment and face lift of passenger shipboard facilities to the twenty first century range passenger specification. An example is the cruise ship Albatross of 28,518 GT which has been fitted with four Wärtilä main engines, displacing the old Sulzer 9ZH40/48 engines. The ship was built in 1973 and the engine transplant undertaken in 2005 in Hamburg's Blohm &Voss repair yard.

Many maritime economists take the view that there will be two prime divisions in the foreseeable future. The mega-cruise tonnage of 2,000 passenger capacity and above and the smaller cruise vessels which will operate in niche markets.

The cruise business is in the van of change as new tonnage is launched and the most recent innovation was launched in 2005 with the Stelios Haji Ioannou ship easy Cruise One. It’s focused on the younger audience. Overall it provides a holiday price which is exclusive - not inclusive - and the vessel has very few amenities. The vessel has 74 double cabins and seven four berth cabins, all of which are internal. All cabins have bathroom facilities.

Four suites are on the top deck. The cabin accommodation is spread over five decks. A sports bar is provided which serves food, a cocktail bar with a whirlpool outside, and a Caffe Ritazza for coffee. Overall the prices (in 2005) for one night are US$56 for a two berth cabin with a minimum stay of two nights. Once passengers are on the ship it will cost US$20 each time they want their cabin made up. The marine management is under V Ships of Monaco and the ship operates in the Mediterranean and serves the French and Italian Rivieras.

General structure of cargo vessels

Cargo vessels can be classified according to their hull design and construction.

Single-deck vessels have one deck, on top of which are often superimposed three 'islands': forecastle, bridge and poop. Such vessels are commonly referred to as the 'three-island type'. This type of vessel is very suitable for the carriage of heavy cargoes in bulk, as easy access to the holds (with only one hatch to pass through) means that they are cheap to load and discharge.

The most suitable cargoes for single-deck vessels are heavy cargoes carried in bulk, such as coal, grain and iron ore. However, these vessels also customarily carry such light cargoes as timber and esparto grass, which are stowed on deck as well as below, the large clear holds making for easy stowage and the three islands affording protection for the deck cargo. This type of vessel is not suitable for general cargo, as there are no means of adequately separating the cargo.

There are a number of variations in the single-deck type of vessel. Some vessels, for example, may be provided with a short bridge while others have a longer bridge.

The 'tween-deck type of vessel has other decks below the main deck, and all run the full length of the vessel. These additional decks below the main deck are known as the 'tween decks; some vessels in the liner trades often have more than one 'tween deck, and they are then known as the upper and lower 'tween decks. 'Tween-deck tonnage is now much in demise, as containerization supersedes it.

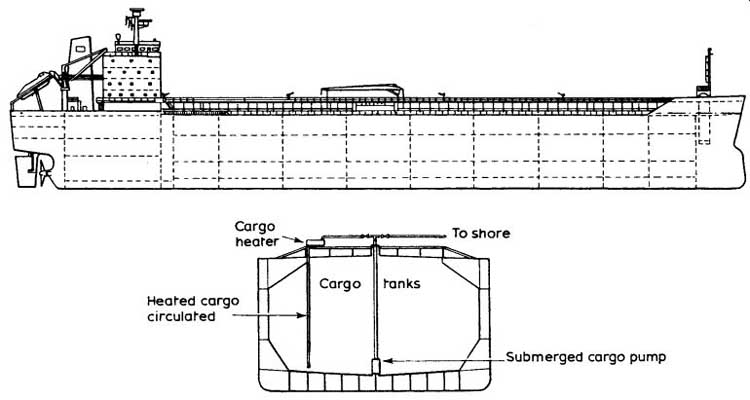

An example of a products carrier is found in Fgr. 3.3. It has an overall length of 182.5 m and a draught of 11.0 m. The service speed is 14 knots.

The vessel has a twin-skin double bottom hull structure to give clean, smooth cargo tanks permitting easy and rapid cleaning from one cargo to another with reduced heating and coating maintenance costs; individual tank-mounted cargo pumps which strip the tanks efficiently without the problems of long suction lines thereby obviating the need to have a shipboard pump room; deck-mounted heat exchangers for efficient control of cargo temperature; and versatility of cargoes embracing all of the common oil products and a range of easy chemicals including gasoline, aviation gasoline, jet fuel, naphtha, diesel fuel, fuel oil, caustic soda, ethanol, BTX, vegetable oil and molasses.

It has a total deadweight tonnage of 47,300 and a cargo capacity of 50,000 m^3 which For example would be sufficient for a 30,000 tonne cargo of naphtha. The vessel has nine tanks and crew accommodation for 25 persons.

The vessel is suitable for worldwide trading in the bulk product markets.

It’s called the Tango products carrier. An example of a container vessel is found in Fgr. 3.4. It has an overall length of 162 m and draught of 9.75 m.

It has a total deadweight tonnage of 21,800 and a container capacity of 1,739 TEUs. The service speed is 18 knots. It has eight hatches. All are unobstructed to provide full width 40 ft length openings and are closed by lift on/lift off pontoon-type hatch covers. All the holds are designed for 40 ft containers; 20 ft boxes can be stowed using a combination of cell guides, side bars and stacking cones without the use of portable guides or dedicated holds. Three electro-hydraulically operated slimline deck cranes are provided, each of 36 tonnes capacity.

The vessel is suitable for feeder services under the hub and spoke network (--396). It’s called a Compact container ship and is built by British Ship builders Ltd in a size range from 600 to 2,100 TEUs. Sometimes such tonnage is described as cellular cargo vessels when the holds have been designed to form a series of cells into which the containers are placed.

Fgr. 3 Tango products carrier, 47,300 dwt, ideal for bulk shipment of gasoline,

aviation gasoline, jet fuel, naphtha diesel fuel, fuel oil, caustic soda, ethanol,

BTX, molasses and vegetable oil. (British Shipbuilders Ltd)

Fgr. 4 Compact container ship of 21,800 dwt and capacity of 1,739 TEU. The

crucial feature is its flexibility and fuel economy, as it can hold both 20

ft and 40 ft containers, plus the maximum earning capacity with higher container

numbers for the hull envelope. It’s ideal for worldwide container trading.

(British Shipbuilders Ltd)

Economics of new and second-hand tonnage

The most decisive factors influencing the ship owner’s choice between new and second-hand tonnage are the availability of capital and its cost.

The economics of new and second-hand tonnage now form an important part of ship management. Moreover, with ship costs continuing to rise, the economics of buying a relatively modern ship of up to five years in age proves an attractive proposition despite the conversion cost, especially for countries experiencing hard currency problems.

Among the disadvantages inherent in buying new tonnage is the adequate depreciation of the vessel during its normal working life to provide funds for replacement. At present, in some countries, depreciation is based on initial and not on replacement cost, which because of inflation is likely to be considerably higher. Further disadvantages include the risk of building delays; uncertain costs at time of delivery if the vessel is not being built on a fixed price; and lastly a possible recession in the market when she is ready to trade.

Further advantages/disadvantages of buying new tonnage are given below:

(a) The vessel is usually built for a particular trade/service and therefore should prove ideal for the route in every respect, i.e. speed, economical crewing, ship specification, optimum capacity, modern marine engineering technology, ship design, etc. In short, it should be able to offer the optimum service at the lowest economical price.

(b) It usually raises service quality and such an image should generate additional traffic.

(c) It facilitates optimum ship operation particularly if there is a fleet of sister ships aiding minimum stocking of ship spares/ replacement equipment to be provided.

(d) Service reliability should be high.

(e) Maintenance and survey costs should be somewhat lower than older second-hand tonnage, particularly in the early years.

(f) New tonnage presents the opportunity to modernize terminal arrangements, particularly cargo transhipment, cargo collection and distribution arrangements, etc. Overall it should improve the speed of cargo transhipment arrangements and reduce ship port turn-round time to a minimum.

This all helps to make the fleet more productive.

(g) A significant disadvantage is the timescale of the new tonnage project which can extend up to three years from the time the proposal is first originated in the shipping company to when the vessel is accepted by the ship-owner from the shipyard following successful completion of trials. During this period the character and level of traffic forecast could have dramatically adversely changed. In such circumstances it may prove difficult to find suitable employment for the vessel elsewhere.

(h) Annual ship depreciation is substantially higher than the vessel displaced whilst crew complement would be much lower.

With second-hand tonnage, the ship-owner has the advantage of obtaining the vessel at a fixed price, which would be considerably lower per deadweight ton in comparison with a new vessel. Furthermore, the vessel is available for service immediately the sale is concluded. Conversely, the ship-owner will have to face higher maintenance costs, lower reliability, generally higher operating costs and a quicker obsolescence. It can create a bad image for the service. He is also unlikely to benefit from any building subsidies or cheap loans - available for the new tonnage in certain countries - despite the fact that the ship-owner may be involved in a conversion of the second-hand tonnage.

Other significant advantages and disadvantages of second-hand tonnage are detailed below:

(a) On completion of the purchase the vessel is basically available for service commencement. However, usually the new owner will wish to have the ship painted to his own house flag colors and undertake any alterations to facilitate the economic deployment of the vessel. For example, a new section could be inserted in the vessel to lengthen it and increase cargo accommodation. The extent of such alterations will depend on the trade, age and condition of the vessel and capital availability. The paramount consideration will be the economics of the alterations and capital return of the investment.

(b) Second-hand tonnage is ideal to start a new service, enabling the operator to test the market in a low-risk capital situation. In the event of the service proving successful, new tonnage can be introduced subsequently.

Likewise, to meet a short-term traffic increase extending over 18/24 months, it may prove more economic to buy second-hand tonnage rather than charter. The advantage of a charter is that the vessel is ultimately returned to the owner to find employment although with some charters one can have an option to purchase on completion of the charter term.

(c) Second-hand tonnage tends to be costly to operate in crewing and does not usually have the ideal ship specification, i.e. slow speed, limited cargo capacity, poor cargo transhipment facilities. Such shortcomings can be overcome by ship modification, but it’s unlikely to produce the optimum vessel for the service. Ship insurance premium is likely to be high with older vessels, particularly over 15 years.

(d) The vessel is likely to have a relatively short life and maintenance/survey/ operating costs are likely to be high. If the ship registration is to be transferred from one national flag to another, this can prove costly as standards differ. Moreover, it’s not always possible to assess accurately the cost involved until conversion work is in progress. Conversely depreciation is likely to be low.

(e) Service quality could be rather indifferent whilst reliability/ schedule punctuality could be at risk. For example, the engines may be prone to breakdown and additional crew personnel may be required to keep them maintained to a high reliable standard.

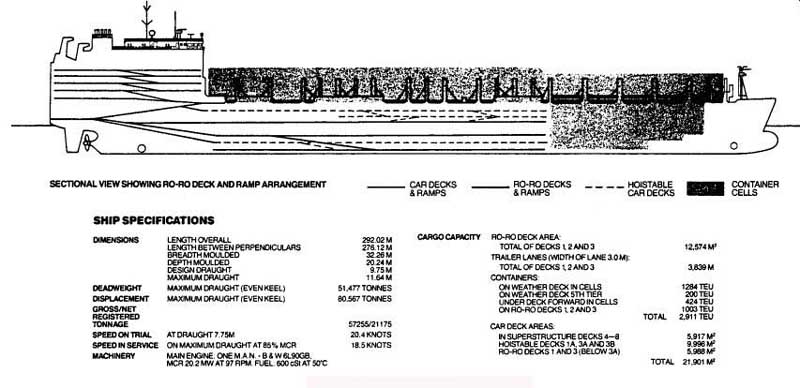

An example of a lengthened third-generation ro/ro container ship is provided in Fgr. 3.5. It has a draught of 7.75 m, a speed of 20.4 knots and 51,477 dwt.

Fgr. 5 Lengthened third generation ro-ro/container ship. (Atlantic Container

Line)

Finally the ship operator, when conducting the feasibility study of whether to opt for new or second-hand tonnage, must also consider chartered or leased tonnage. Advantages include no long-term commitment or disposal problems but merely its economical operation for the duration of the charter; almost immediate access to the ship to commence operation; the prospect of a wider range of vessels available for fixture; and finally the prospect of a more economical modern-type vessel being available. Many shipowners tend to introduce new services or supplement existing services through chartered tonnage.

Market forecasts represent an important aspect in the acquisition of second hand ships and the interface between potential freight and operating/capital costs. Hence the entrepreneur buying second-hand tonnage must formulate an action plan embracing all the ingredients of the project and a project manager in sole charge. A key factor is the vetting of the ship, involving a physical examination and ideally in a dry dock involving an independent surveyor evaluation. All the ship's documents must be thoroughly examined and checked to establish the history of the vessel. The experienced surveyor will be familiar with future regulations involving IMO conventions and the operational/financial compliance with such obligations. The interface between the ship specification and the ports of call must be examined. Any ship modification embracing lengthening, engine transplant, hold modification or refurbishing, such as cruise tonnage, cargo transhipment equipment, must be examined. A financial appraisal is required embracing income/freight, operating cost, crew, fuel, port charges, expenditure embracing survey, insurance and capital investment embracing ship alterations and legal compliance embracing SOLAS, etc., provisions. It may be prudent to examine several vessels and conduct a feasibility study of each to decide the best one. A memorandum featuring all these points and financial appraisal over a five year cycle. A key factor is the method of funding the second-hand tonnage, including return on capital. Commercial loans, sale of displaced tonnage, raising capital on the open market. The implications of gearing must be considered.