Whether we drill for oil, dig for coal, harvest the forests, spilt the atom, or harness the sun, there is no question that energy is going to cost us more in the near future than it used to. The waft you save may be your own dollar.

Once upon a time, and not so very long ago, it seemed as if the fuels we used for energy would always be abundant and inexpensive. The United States had a wealth of its own energy resources and for many years was the world’s foremost producer of oil and natural gas. Not until the middle of the 1950s did the lower prices of fossil fuels from other countries make importation an economic necessity.

In those early years we did what humans have always done: We used what the earth provided, first to fulfill our needs and then to fulfill our desires. As the leading industrial nation in the world we enjoyed a high standard of living, which contributed to, but was not the sole cause of, the fact that our energy consumption doubled in the 20 years following World War II; and that rate of growth continued to increase. To support our energy consumption we imported more foreign oil. With about 6 percent of the world’s population, the United States consumed al most a third of the world’s energy. We used some of that energy to produce about a quarter of the world’s industrial and consumer goods, and about half of the world’s food exports.

The Arab oil embargo raised the price of crude oil imported into this country from $3.41 per barrel in 1973 to $11 .11 per barrel in 1974. That precipitous price rise was reflected most obviously at the gas pumps and in home heating fuel costs, and we began to speak about an energy crisis.” As fuel prices increased even more over the following years we were forced for the first time in modern history to examine our energy consumption and production patterns. We found that as a nation and as individuals we had be come heavily dependent on, even addicted to, cheap fossil fuels.

Now, in the 1980s, oil fills more than half our nation’s total energy requirements. Since we import more than half the oil we use—at an annual cost of some $90 billion—we find our country’s economy dangerously vulnerable to interruptions in its oil supply, and equally vulnerable to foreign oil price hikes.

Meanwhile, despite frequent and substantial increases in the costs of our gas and oil, we continue to burn up these nonrenewable fuels at a prodigious rate. Non renewable means simply what it says: What we use is gone forever.

Reliable experts assure us that we are a long way from exhausting the world’s reserves of any of the fossil fuels. But we have come close to exhausting the gas and oil supplies that are easy, and there fore inexpensive, to reach. Most new gas and oil explorations are taking place, not in the open fields of Texas and Oklahoma, but in the frigid waters of the North Sea, or four miles beneath the surface of Louisiana. If these explorations are successful, decades worth of oil and gas may become available to us.

Considerable amounts of coal—both soft bituminous and hard anthracite— remain unmined in many parts of the world. According to some experts, the United States alone possesses enough coal to supply our current home energy needs for several centuries, although we must find a way to keep the air clean if we are to use it.

Nuclear fission is an established source of energy throughout the world, and generates about 10 percent of the electrical energy used in the United States. It is to be hoped that the controversies that have surrounded its further development will be satisfactorily re solved. Nuclear fusion remains a potential energy source only, since it has not yet been clearly demonstrated to be a safe, controlled, and practical resource.

Geothermal energy, using the natural heat from inside the earth, is practical only where the underground magma nears the planet’s surface. For this and other reasons geothermal will provide energy in the future, mostly in the form of electrical generation.

Electricity, which must be produced by converting other sources of energy, is generated by coal, oil, gas, nuclear power, and water power. Hydroelectric plants will contribute to that generation, as they have for years; and the wind is being explored as another clean, renewable, and easily converted energy source.

Laboratory chemists are developing synthetic oil and gas from coal, shale rock and tar sands. These synthetic fuels are already in production in several American plants. But they are still somewhat experimental, and even if the attendant problems are solved in the very near future, we are at least several years away from having enough volume of such fuels to make a major contribution to our energy needs.

Solar energy, the focus of intense development in the past decade, has demonstrated some useful capabilities, particularly in its simple, passive forms.

Every one of these sources of energy is likely to be applied in the near future, in the United States and elsewhere in the world. We have only recently agreed that there is an energy problem; and we are still seeking the solutions that will carry us through the long term.

Increased exploration and production costs result, of course, in higher fuel costs to the nation and to the individual. While we are not in fact on the verge of running out of energy sources, the abrupt difficulty and expense of securing what we used to get so easily and cheaply suggest that we had best take some action to ease the strain on our selves for the next few decades.

Obviously, most of us are not about to grab our drilling rigs and go off in search of new oil wells. But surprisingly, each of us can uncover some very substantial fuel reserves right in our own homes. We can start to ease the energy burden on our nation’s economy, and simultaneously ease the strain on our own wallets and checkbooks.

That is what this guide is all about reducing your energy expenditures in ways your can see and measure. In a very real sense, saving energy has come to equal saving money. As individuals, we do not have to wait for national policy before we take action on our own behalf. We can make the difference in our own energy bills. and when enough of us do so we will make a collective difference in the self-sufficiency of our country.

Guide to Energy-Saving Projects for the Home is made up of six sections. Rather than exploring geothermal energy, or nuclear plant development, this content is designed to be of practical use to you. The guide is intended to present you with options, so that you will know what you can do to reduce your energy consumption and therefore your reliance on our increasingly expensive supplies of oil and gas.

You will find that your options range from extremely simple steps that cost you nothing yet bring you measurable savings within 30 days, to complex installations that may not pay back for years, but that will immediately add to your comfort and energy-independence.

The sections that follow are intended to be guidelines, and not cookbook solutions to energy questions. Because every situation is different, any given form of energy efficiency, from a simple conservation measure to an extensive solar installation, may or may not be worthwhile in your particular case. This guide should help you come to your own decisions.

Conservation

Of all the options open to you, conserving what you already use—gas or oil or electricity—is by far the easiest, fastest, cheapest, and most direct and cost-effective way to save energy and energy dollars. There is no debate on this issue. But before you envision yourself and your family shivering and huddled around a fire, let us reassure you that conservation does not mean going without com fort. Conservation is about the quality of energy use, not the quantity. It only appears to be about quantity because when energy is used wisely, less of it is used.

Residential buildings use about 20 per cent of all the energy consumed in the United States, and of that about 70 per cent is used for space conditioning: the heating and cooling of living areas. Yet only about 2 percent of American homes are insulated well enough to retain their heat in cold weather, or their coolness in hot weather. You would be horrified if it were suggested that you leave your front door open all winter and let your heating dollars fly away. But according to the U.S. Department of Energy, a ¼-inch thick crack under your front door will waste about as much of your heating bill as if you had a 2- by 2-inch hole in your wall. You may also be losing heat through the cracks above and below your exterior doors; the tiny crack around your mail slot; the little chink out around the exhaust duct of your clothes dryer; a few loose windows. It all adds up. You can see that it’s worth your while to slow the rate at which your house loses the air you have paid to heat or cool to your liking.

It’s so easy to overlook small cracks in your house—some are almost

impossible to see without really looking for them. But these cracks are

the “holes” through which your heat— and your energy dollars—slip out.

See elsewhere in this guide for details on caulking all around your house.

For maximum long-term home energy conservation gains, a general program that covers all your energy drains will probably serve you best. Only you can design that program, because only you can find out exactly where and how much of your energy is being wasted.

Perhaps you don’t want to invest a great deal of time and effort in a conservation program just yet. You might prefer to get started in a small way, to see what conservation feels like in your life. In the content below, you will find some no-cost common sense ways to reduce your energy consumption immediately. By paying attention to your daily energy-consuming patterns, you can make small changes that won’t cost you a penny but could easily save you 10 to 20 percent of your total energy bill.

If you choose to make larger changes around the house, you may find financial assistance just a phone call away. Before you make any investment in an energy-saving measure, you should check out the various sources for such financial help. The last two areas of this section outline some of the options open to you, including low-interest loans and tax incentives.

Whether you choose to make big changes or small ones, you can’t really know what you are wasting until you know what you are spending, and be fore you make any changes, you should know where your house is leaking the most energy. The next section, “The Energy Audit,” presents a home audit that you can do yourself. This audit will give you a good idea of where you can take steps to save energy and energy dollars that will be the most cost-effective for your particular situation.

The following section, “Plugging the Energy Leaks: The House,” takes a close look at the house, describing in detail some of the alterations you might have to make in its structure that will save energy. We also examine the costs of these alterations, so that you can be gin to judge whether they are worthwhile for you.

In the third section, “Plugging the Energy Leaks: The Systems,” we look into the systems that operate in your house to keep it warm or cool, examining the changes you can make to save money and energy. and again we offer some guides that will enable you to determine whether these are changes you care to make.

After examining your house as it stands now, the next section, “Solar Energy,” introduces the theory and practice of solar energy applications. Can the sun solve your energy problems? Only you and the shadows can know for sure. In the final section, “Wood and the Other Alternatives,” instead of looking resolutely forward, we look back at an energy source that supplied virtually 100 percent of the fuel energy used by our forefathers when they came to this land: wood. But something has changed about the use of fuel wood in the past couple hundred years, and that is the firebox it’s burned in. Therefore we will look at some of the different kinds of stoves and fireplace amendments you can buy that will make burning wood an efficient and heart warming experience.

And finally, we will take a quick look at wind and water as sources of home energy production. While these are still a long way from being in common use by the average homeowner, more and more people are investigating them as alternatives.

No matter what you do, the first step is to increase your awareness of how much money you are throwing away by continuing your old, familiar energy consuming habits. We all have them, but changing these habits doesn’t have to be painful. It can be a pioneering adventure into the energy-saving patterns of the future.

No-cost, No-work Energy-Saving Ideas

Conserving energy is a little bit like going swimming. People eager to practice their kicks may leap right into the deepest waters, while others, less certain of the process or the results they may expect, dip a tentative toe in the shallows and wait a moment to see what hap pens before committing themselves further. But what all swimmers have in common is the need to get wet before taking the first real stroke.

In the next couple of paragraphs we want to remind you that getting wet can be simple and painless. Whether you are already serious about saving energy, or just beginning to think it might be a good idea, the advice that follows should be the basis of your must-do list. These are some of the easiest, most common- sense free steps you can take to reduce your home energy consumption and save your first home energy dollars. All it takes is a small change of habits.

It has been estimated by the Department of Energy and other expert watch dogs of our nation’s resources that a household may save as much as 10 to 20 percent on home energy bills by following just such steps as these. Of course, we can't say exactly how much taking these measures will save you, since the results you achieve will depend on such variables as where you live, how energy-conscious you are already, and the particular necessities of your life-style. If, for example, you are unwilling to give up the luxury of standing in the hot shower for ten minutes every morning, the bill for fuel to heat your water will not drop as precipitously as it might if you learned to get in, get wet, turn off the water, soap up, turn on the water, rinse off, and get out. But there are measurable savings in every item on this list—and you will undoubtedly be able to add some suggestions of your own.

• Refrigerator: Keep condenser coils clean for greater efficiency.

- Turn thermostat setting up from 37°F to 40°F.

- Turn off ice maker when not in use.

- Keep refrigerator horizontally level for efficient operation (a glass of water on a refrigerator shelf will show whether it’s level).

- Defrost when frost is 1 thick.

- Keep doors tightly closed.

- Open doors only when necessary.

- Close doors as soon as you’ve put food in or taken it out.

- Cool hot foods before refrigerating. Organize foods for ease in locating to minimize time with door open.

- Cover all liquids—high humidity re quires more energy.

• Stove: If you buy a gas range, select one with a pilotless ignition.

- Check gas stove flame color: yellow traces mean burners may be clogged and require cleaning.

- Self-cleaning ovens are huge energy consumers; clean them by hand.

- Defrost foods before cooking.

- Preheat your oven only long enough for it to reach the desired temperature.

- Match pots and pans to burner size. Use flat-bottomed pans with tight- fitting lids.

- Keep oven doors tightly closed. Use surface units when possible; ovens and broilers require more energy.

- Make one-pot meals such as stews and casseroles.

- Bake several things at once instead of a single item—the oven is going to heat up anyway.

- Do not peek into the oven while it’s on—each peek drops the temperature by 25°F to 50°F or even more.

- Use toaster ovens or portable appliances for small quantities of food.

- Use microwave ovens to cook small quantities of food. (Microwave ovens can be energy wasters if used to cook for five or more people.)

- Heat a ceramic tile while baking. Use the tile rather than the oven to keep rolls hot.

- Warm dishes or breads in retained heat after oven is turned off.

• Dishwasher: Rinse dishes in cold water before placing them in the dish washer.

- Keep dishwasher drains and filters clear of debris.

- Run dishwasher for full loads only.

• Laundry: Rinse clothes in cold or warm water, not hot.

- Wash full loads only, but remember that overloading wastes energy, too.

- Special features on the washer, such as soak cycles and suds savers, con serve water and cut down on operating time of the machine—use whenever possible.

- Use a clothesline instead of dryer whenever possible.

- Clean lint filter on dryer after every use. Over-drying articles makes clothes harsh-feeling and wastes energy.

- Iron as little as possible—ironing uses as much energy as ten 100-watt bulbs. Instead, remove clothes from dryer immediately so that wrinkles do not set in.

• Bathroom: Turn temperature of water heater down to 120°F.

- Fix leaking faucets and worn washers immediately.

- Use flow restrictors in sink and shower.

- Do not run hot water continuously while washing hands or shaving.

- Take showers—they generally use less hot water than baths.

- Take shorter and cooler showers.

• Lights: Turn off lamps when not in use. Use the lowest setting on 3-way bulbs whenever possible, particularly when watching TV.

- Use lampshades with a white liner for better reflection.

- Place work tables and desks near windows to take advantage of daylight.

- Use fluorescent fixtures whenever possible.

- Arrange lamps to reflect off two walls—more light is reflected than if the lamp is against one wall.

• Heating: Winter thermostat settings: daytime, 65° F to 68° F; nighttime, 60° F; unused areas, 50° F.

- Keep windows clean to let in more sun.

- Always keep heating sources clean. Dirty filters, grills, and coils mean wasted energy.

- Keep chimney clean.

- Completely seal off any unused doors to the outside for the winter.

- Keep all exterior doors closed tightly.

- Keep mail chutes and milk chutes closed.

- Close damper when the fireplace is not in use.

- Use shades, drapes, shutters or curtains on all windows—they slow heat loss through glass.

- Keep drapes open on sunny days and closed on cloudy days and at night.

- Do not heat unused rooms, and keep doors to these rooms closed.

- Keep furnace cold-air register unobstructed.

- Close windows near thermostat. Keep indoor/outdoor traffic to a minimum.

- Move furniture that blocks hot- or cold- air registers.

- Lower the thermostat if a large group of people will be in the room—their body heat will warm the room.

- Wear extra layers of clothing for warmth.

- Do baking in afternoon and keep small children in the kitchen where it’s warm.

- Never use the oven just to heat a room, but do take advantage of the heat when you must use the oven.

- After baths are finished, allow the steam to heat the bathroom and up stairs rooms. Drain water when cold.

- Close bathroom door at night before turning down thermostat, keeping heat in bathroom.

- If you sleep with windows open, which wastes energy, at least shut the bed room registers and close the door.

- If the outdoor temperature is 30°F lower than indoor temperature, a fire in the fireplace can draw warmth from the house and result in a net heat loss! Reduce thermostat setting and close all doors to the room with the fire.

- Burn only dry wood in the fireplace.

• Cooling: Keep drapes closed on sunny days and open on cloudy days and at night during the summer months.

- Do not run a humidifier when the air conditioning is operating.

- Protect cooling unit from the sun and from plants that restrict air flow around it.

- Close heating vents when using room air conditioner so that the vents do not fill with cold air.

• Miscellaneous: Unplug “instant on” feature of the TV—it is a constant drain of electricity.

- Turn off appliances when they are not in use—television when no one’s watching, computer, media center and home-theatre system, etc. when no one is using them.

- If you have a waterbed, keep it covered to retain heat.

- Put new seedlings on top of refrigerator or hot water heater for bottom heat.

- Eliminate outdoor decorative lighting.

• Vacation: Be sure all faucets are turned off and do not leak.

- On central furnaces with a disconnect switch, flip the switch to OFF.

- If power supply to any electrical equipment is a simple plug, pull the plug.

- Turn water heater gas control valve to “pilot.”

- Use up perishables and then set refrigerator to warmest setting (not defrost).

- Turn off swimming pool heater and pilot and reduce time clock so filter operates less.

- If you’ll be gone for longer than a month: Turn off air conditioner. Turn off heat and pilot light. Empty refrigerator, turn off, and leave door ajar.

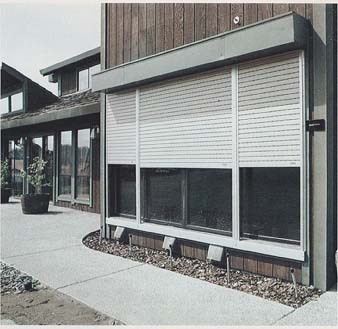

Windows are essentially large holes in the walls of your house, and not very well-covered ones, at that. This automated shutter can let

the sun in or keep it out, and it can be closed at night to insulate

against nighttime heat loss. Various window treatments are covered later

in this guide.

State Tax Incentives

Before you begin any conservation project, you should explore every possible source of financial assistance. Federal and state governments offer tax incentives that may cut your costs significantly. Some utility companies offer loans at low or no interest for energy conservation improvements, so you should be sure to contact them.

There are two distinct categories for financial assistance: weatherization, such as weatherstripping and insulation; and renewable energy resource systems, including solar, wind and geothermal energy.

In at least one state, Alabama, there is also a tax deduction if the primary source of heating in a residence is converted to a wood stove. While most states do not presently have tax incentives for wood stove heating in the home, it’s worthwhile to keep current with your state’s programs for this area of energy savings. If you’ve been con fused by conflicting reports about the kinds of savings, credits, deductions, and other incentives available for your home energy conservation projects, you are not alone. Sometimes even the people making the reports don’t have the most recent data. The entire field of energy conservation is changing and growing so rapidly that Monday’s brilliant new idea is often Tuesday’s ancient relic. It’s almost impossible to keep up with all the new laws, pro ducts, and data that could make a difference to you.

As of 1980 almost every state in the union offers some kind of tax incentive or loan program for the purchase, installation, and /or use of energy-saving measures. Those states that do not presently provide such assistance hope to develop programs shortly.

Because every state’s program is different from every other one, and be cause many of these programs are being changed even as you read this sub-section, the following information is designed to help you find the information you need.

Here are some definitions of common terms that will help you understand what is being offered to you.

• Credits: A tax credit is the amount of money the government allows you to subtract from your owed income tax be cause of money you invested in energy conservation for your home. If the credit you have earned exceeds the taxes you owe, that does not mean you can expect a refund. However, the excess can be carried over and applied to the following year’s taxes. This is not the case with most other tax credit situations.

• Deductions: Deductions are also allowed for money you have invested in energy conservation, but these are subtracted from your total income even before you start to figure your taxes. They actually lower your real, taxable income.

• Loans: In many states, utility companies and related agencies offer conservation loans to their customers at very low interest rates, and sometimes with no interest at all. So if you are considering an investment in an energy-saving project, be sure to call your utility company to find out what financial assistance programs they may have.

• Loans to Veterans: Some states will increase their usual loan limit to veterans who use approved energy-con serving methods in their homes.

• Property Tax Exemptions: In many states, if you increase the value of your house by adding energy-conserving devices to it, your property tax can't be increased on that basis. For example, in the state of Washington, until the year 1986, solar power systems and solar water and space heating systems did not increase the assessed and taxable values for property tax.

• Sales Tax Exemptions: In some states the sale of energy-conserving equipment can't be taxed.

• State Tax Credit: In some states, the amount of credit you can claim for energy conservation measures is reduced by the amount of such credit you claim from the federal government.

To be eligible for state tax credit, systems are expected to last for three years.

The list below provides web links of the main energy department offices and other non-profit organizations. As with everything else in the energy field, it is difficult to stay current because things are moving so fast. By the time you write or phone your state’s office, it may have moved. At the very least however, these numbers will lead you to the numbers of the agencies that can provide you with the information you need. These agencies are the best places to start; if they can’t help you, they will be able to tell you who to contact next.

In many ways it seems as if a house is not a home without a fireplace. and yet most fire places are huge energy wasters. If you don’t want to

give up using your fireplace, there are some things you can do to increase

its efficiency.

Federal and State-based Tax Incentives

Established in 1995, the Database of State Incentives for Renewables and Efficiency (DSIRE) is an ongoing project of the North Carolina Solar Center and the Interstate Renewable Energy Council (IREC). It is funded by the U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy (EERE), primarily through the Office of Planning, Budget and Analysis (PBA). The site is administered by the National Renewable Energy Laboratory (NREL), which is operated for DOE by the Alliance for Sustainable Energy, LLC.

Federal weatherization credits cover insulation, weatherstripping, caulking, storm windows, set-back thermostats, pilotless ignition added to a furnace, and a damper added to a flue. The credit is 15 percent of the cost for the first $2000 spent. The maximum credit is $300.

From January 1 2009 to December 31, 2010, you may subtract from your federal income tax up to 30 percent of the cost of any eligible active solar system or wind or geothermal installation purchased on or after January 1, 2009. The credit applies only to the first $10,000 you spend, for a maximum incentive of $4000.

Systems purchased before 1980 are subject to the old tax credits: 30 percent of the first $2000 spent and 20 percent of the next $8000, with a maximum of $2200 credit available.

The systems covered in these tax incentives are active systems and must be reasonably expected to last for five years after their installation. Items such as windows, extra-thick walls, skylights, greenhouses, and roof overhangs are not included as equipment because they serve other structural functions in the home and are considered passive forms of energy conservation.

Like state tax credits, federal tax credits will not lead to refunds; but any credit left over after all taxes have been de ducted may be carried over onto the following year’s tax form.

Resources:

- 2010 IRS Federal Home Energy Tax Credit Guide

- Consumer Energy Tax Incentives: What the American Recovery and Reinvestment Act Means to You (U.S. Dept. of Energy)

- Federal Tax Credits for Consumer Energy Efficiency

- Department of Energy Weatherization Assistance Program

- ENERGY STAR sales tax exemptions or credits, or rebates on qualified products

Additional resources:

General information:

Added Insulation:

- www.eere.energy.gov/consumer/tips/insulation.html

- North American Insulation Manufacturers Association (NAIMA)

Replacement Windows:

- www.eere.energy.gov/consumer/tips/windows.html

- www.aceee.org/consumerguide/envelope.htm

- www.efficientwindows.org/

- www.nfrc.org/windowshop/

Duct Sealing:

Air Infiltration Reduction:

Home Energy Ratings and Related Services:

Qualifying Roofs:

Figuring Your Finances

10 Solar collectors are becoming a more familiar sight. Solar energy systems are really quite simple in principle: they collect, store, and distribute the heat from the sun’s energy in a controlled fashion.

The following example is a step-by-step approach to figuring the cost of adding attic insulation, weatherstripping and caulking, and installing a solar hot water system in a four-bedroom home. This fictitious home is 2,400 square feet and arbitrarily located in Sacramento, California.

1. After deciding on the energy conservation methods listed above, contact your local utility company. For instance, in northern California the Pacific Gas and Electric Company provides a free home energy audit for its customers. They will show you where your home’s energy leaks are and advise you on any aspects of your proposed project. They will also provide a list of local con tractors to do the work for you.

2. List the cost of each project. The costs for all these projects can vary greatly, depending on how energy efficient you want your home to be. For example:

Solar water heater, contractor installed and certified.

Attic insulation, contractor installed.

Latex acrylic caulking, used around entire home (about 20 tubes).

Weatherstripping, foam-filled gasket stripping around all windows and doors ______

Total: ___

3. Check all possible sources for loans. In California, Pacific Gas and Electric provides a loan of up to $500 for attic insulation. The loan can be made for six months to five years at 8 percent interest, paid monthly beginning on receipt of the first bill. (A more extensive loan service is being approved right now.) So, in our example, the project will cost $2730 out-of-pocket.

4. Check out federal and state tax incentives. In this example, the credits al lowed on federal and state taxes are:

• Federal: For the insulation, weather stripping, and caulking a taxpayer is al lowed 15 percent credit for the first $2000 spent. The maximum credit is $300. In our example, insulation, weatherstripping and caulking come to a total of $730. Therefore, the federal weatherization credit allowance is $109.50. Federal tax credit for a solar water heater is 40 percent of the first $10,000 spent, with a maximum of $4,000 credit. So, in this situation, the credit would be 40 percent of $2500, or $1000. That means that the total federal credits would be:

Weatherization credit____

Solar credit ___

Total federal credit ___

• State: California offers some credits for weatherization, but a passive or active certified solar system is allowed 55 percent credit, with a maximum credit of $3000. For the solar water heater, 55 percent of $2500 equals $1375.

Since the California state tax credit is reduced by the allowable federal credit, whether or not the federal credit is taken, the state solar credit of $1375 would be reduced by the federal solar credit ($1000) for a total allowable state credit of $375. Therefore, the combined federal and state credits would be:

Federal Credits

Weatherization $ ___

Solar $ ___

State Credits

Solar $ ___

Total Credits ____

5. ___ out your actual costs and initial cash outlays. Of the total costs for all improvements in our example, with or without a loan, $1484.50 can be credited against your federal and state taxes.

This means that your total cost for the purchase and installation of your improvements would be $3230 less $1484.50, or $1745.50. If you do take a loan to reduce your initial cash out lay, you would add to these costs the additional interest on the loan. But, as noted above, the initial cash outlay would be reduced from $3230 to $2730.

6. Determine your expected savings from these improvements. (See the chart for a sample of solar water heater savings, in a later section.) The combination of these figures—the cost of purchase and installation, estimated fuel savings from the improvements, term and amount of your loan repayment—will give you a relatively accurate picture of your energy dollar outlays and savings. With these kinds of calculations, you can decide which of the improvements seem most cost- effective for you.

7. Examine your alternatives. In our example, you might decide to complete only the weatherization part of your pro gram. In that case, your total estimated cost would be $730. Of that total, $109 could be credited against your federal taxes, bringing your actual cost down to $621. and , with a $500 loan from your utility company, your initial cash outlay would be only $230. Your loan repayment could be as low as $10 per month, and your savings could be as much as 25 to 30 percent of your monthly fuel bill.

This example can guide you through the same steps for your personal situation in your state. You will not necessarily follow it exactly—don’t be limited by it, or expect that your state or utility company will have the same programs and incentives. But be sure to check out all the options of financial assistance that may be available to you.

Next: The Energy Audit

Prev: Index of Articles