LEARNING GOALS:

• Describe an overall framework for project integration management as it relates to the other project management knowledge areas and the project life cycle

• Discuss the strategic planning process and apply different project selection methods

• Explain the importance of creating a project charter to formally initiate projects

• Describe project management plan development, understand the content of these plans, and review approaches for creating them

• Explain project execution, its relationship to project planning, the factors related to successful results, and tools and techniques to assist in directing and managing project work

• Describe the process of monitoring and controlling a project

• Understand the integrated change control process, planning for and managing changes on information technology (IT) projects, and developing and using a change control system

• Explain the importance of developing and following good procedures for closing projects

• Describe how software can assist in project integration management

=============

OPENING CASE

Nick Carson recently became project manager of a critical biotech enterprise at his Silicon Valley company. This project involved creating the hardware and software for a DNA-sequencing instrument used in assembling and analyzing the human genome. The biotech project was the company's largest endeavor, and it had tremendous potential for future growth and revenues. Unfortunately, there were problems managing this large project. It had been under way for three years and had already gone through three different project managers. Nick had been the lead software developer on the project before top management made him the project manager. The CEO told him to do whatever it took to deliver the first version of the DNA-sequencing software in four months and a production version in nine months. Negotiations for a potential corporate buyout with a larger company influenced top management's sense of urgency to complete the project.

Highly energetic and intelligent, Nick had the technical background to make the project a success. He delved into the technical problems and found some critical flaws that kept the DNA-sequencing instrument from working. Nevertheless, he was having difficulty in his new role as project manager. Although Nick and his team got the product out on time, top management was upset because Nick did not focus on managing all aspects of the project. He never provided them with accurate schedules or detailed plans of what was happening on the project. Instead of performing the work of project man ager, Nick had taken on the role of software integrator and troubleshooter. Nick, how ever, did not understand top management's complaints--he delivered the product, didn't he? Didn't they realize how valuable he was?

============

WHAT IS PROJECT INTEGRATION MANAGEMENT?

Project integration management involves coordinating all of the other project management knowledge areas throughout a project's life cycle. This integration ensures that all the elements of a project come together at the right times to complete a project success fully. According to the PMBOK Guide, Fifth Edition, six main processes are involved in project integration management:

1. Developing the project charter involves working with stakeholders to create the document that formally authorizes a project-the charter.

2. Developing the project management plan involves coordinating all planning efforts to create a consistent, coherent document-the project management plan.

3. Directing and managing project work involves carrying out the project management plan by performing the activities included in it. The outputs of this process are deliverables, work performance information, change requests, project management plan updates, and project documents updates.

4. Monitoring and controlling project work involves overseeing activities to meet the performance objectives of the project. The outputs of this process are change requests, project management plan updates, and project documents updates.

5. Performing integrated change control involves identifying, evaluating, and managing changes throughout the project lifecycle. The outputs of this pro cess include change request status updates, project management plan updates, and project documents updates.

6. Closing the project or phase involves finalizing all activities to formally close the project or phase. Outputs of this process include final product, service, or result transition and organizational process assets updates. FIG. 1 summarizes these processes and outputs, and shows when they occur in a typical project.

FIG. 1 Project integration management summary.

Many people consider project integration management the key to overall project success.

Someone must take responsibility for coordinating all of the people, plans, and work required to complete a project. Someone must focus on the big picture of the project and steer the project team toward successful completion. Someone must make the final decisions when conflicts occur among project goals or people. Someone must communicate key project information to top management. These responsibilities belong to the project manager, whose chief means for accomplishing all these tasks is project integration management.

Good project integration management is critical to providing stakeholder satisfaction.

Project integration management includes interface management, which involves identifying and managing the points of interaction between various elements of a project. The number of interfaces can increase exponentially as the number of people involved in a project increases. Thus, one of the most important jobs of a project manager is to establish and maintain good communication and relationships across organizational interfaces.

The project manager must communicate well with all project stakeholders, including customers, the project team, top management, other project managers, and opponents of the project.

What happens when a project manager does not communicate well with all stake holders? In the section's opening case, Nick Carson seemed to ignore a key stakeholder for the DNA-sequencing instrument project-his top management. Nick was comfortable working with other members of the project team, but he was not familiar with his new job as project manager or the needs of the company's top management. Nick continued to do his old job of software developer and took on the added role of software integrator. He mistakenly thought project integration management meant software integration management and focused on the project's technical problems. He totally ignored what project integration management is really about--integrating the work of all of the people involved in the project by focusing on good communication and relationship management. Recall that project management is applying knowledge, skills, tools, and techniques to meet project requirements, while also meeting or exceeding stakeholder needs and expectations.

Nick did not take the time to find out what top management expected from him as the project manager; he assumed that completing the project on time and within budget was sufficient to make them happy. Yes, top management should have made its expectations more clear, but Nick should have taken the initiative to get the guidance he needed.

In addition to not understanding project integration management, Nick did not use holistic or systems thinking (see Section 2). He burrowed into the technical details of his particular project. He did not stop to think about what it meant to be the project manager, how this project related to other projects in the organization, or top management's expectations of him and his team.

Project integration management must occur within the context of the entire organization, not just within a particular project. The project manager must integrate the work of the project with the ongoing operations of the organization. In the opening case, Nick's company was negotiating a potential buyout with a larger company. Consequently, top management needed to know when the DNA-sequencing instrument would be ready, how big the market was for the product, and if the company had enough in-house staff to continue to manage projects like this one in the future. Top management wanted to see a project management plan and a schedule to help monitor the project's progress and show the potential buyer what was happening. When top managers tried to talk to Nick about these issues, he soon returned to discussing the technical details of the project. Even though Nick was very bright, he had no experience or real interest in many of the company's business aspects. Project managers must always view their projects in the context of the changing needs of their organizations and respond to requests from top management. Likewise, top management must keep project managers informed of major issues that could affect their projects and strive to make processes consistent throughout their organization.

==========

WHAT WENT WRONG?

The Airbus A380 megajet project was two years behind schedule in October 2006, causing Airbus' parent company to face an expected loss of $6.1 billion over the next four years. Why? The project suffered from severe integration management problems, or "integration disintegration. … [W]hen pre-assembled bundles containing hundreds of miles of cabin wiring were delivered from a German factory to the assembly line in France, workers discovered that the bundles, called harnesses, didn't fit properly into the plane. Assembly slowed to a near-standstill, as workers tried to pull the bundles apart and re-thread them through the fuselage. Now Airbus will have to go back to the drawing board and redesign the wiring system." How did this lack of integration occur? At the end of 2000, just as Airbus was giving the go-ahead to the A380 project, the company announced that it was completing the process of transforming itself into an integrated corporation. Since its founding in 1970, Airbus had operated as a loose consortium of aerospace companies in several countries, including France, Germany, Britain, and Spain. The company wanted to integrate all of its operations into one cohesive business. Unfortunately, that integration was much easier said than done and caused major problems on the A380 project. For example, the Toulouse assembly plant used the latest version of a sophisticated design software tool called CATIA, but the design center at the Hamburg factory used an earlier version-a completely different system dating from the 1980s. As a result, design specifications could not flow easily back and forth between the two systems. Airbus's top managers should have made it a priority to have all sites use the latest software, but they didn't, resulting in a project disaster.

===========

Following a standard process for managing projects can help prevent some of the typical problems new and experienced project managers face, including communicating with and managing stakeholders. Before organizations begin projects, however, they should go through a formal process to decide what projects to pursue.

STRATEGIC PLANNING AND PROJECT SELECTION

Successful leaders look at the big picture or strategic plan of the organization to determine what types of projects will provide the most value. Some may argue that project managers should not be involved in strategic planning and project selection because top management is usually responsible for these types of business decisions. But successful organizations know that project managers can provide valuable insight into the project selection process.

Strategic Planning

Strategic planning involves determining long-term objectives by analyzing the strengths and weaknesses of an organization, studying opportunities and threats in the business environment, predicting future trends, and projecting the need for new products and ser vices. Strategic planning provides important information to help organizations identify and then select potential projects. Many people are familiar with SWOT analysis-analyzing Strengths, Weaknesses, Opportunities, and Threats-which is used to aid in strategic planning. For example, a group of four people who want to start a new business in the film industry could perform a SWOT analysis to help identify potential projects. They might determine the following based on a SWOT analysis:

Strengths:

• As experienced professionals, we have numerous contacts in the film industry.

• Two of us have strong sales and interpersonal skills.

• Two of us have strong technical skills and are familiar with several filmmaking software tools.

• We all have impressive samples of completed projects.

Weaknesses:

• None of us have accounting or financial experience.

• We have no clear marketing strategy for products and services.

• We have little money to invest in new projects.

• We have no company Web site and limited use of technology to run the business.

Opportunities:

• A current client has mentioned a large project she would like us to bid on.

• The film industry continues to grow.

• There are two major conferences this year where we could promote our company.

Threats:

• Other individuals or companies can provide the services we can.

• Customers might prefer working with more established individuals and organizations.

• There is high risk in the film business.

Based on their SWOT analysis, the four entrepreneurs outline potential projects as follows:

• Find an external accountant or firm to help run the business.

• Hire someone to develop a company Web site, focusing on our experience and past projects.

• Develop a marketing plan.

• Develop a strong proposal to get the large project the current client mentioned.

• Plan to promote the company at two major conferences this year.

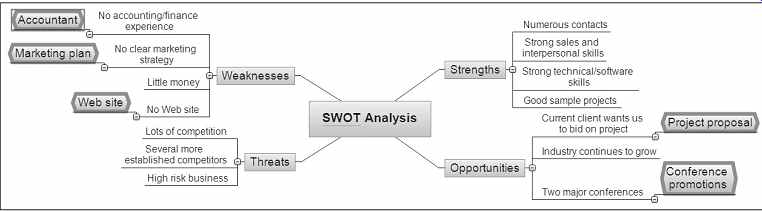

Some people like to perform a SWOT analysis by using mind mapping, a technique that uses branches radiating from a core idea to structure thoughts and ideas. The human brain does not work in a linear fashion. People come up with many unrelated ideas. By putting those ideas down in a visual mind map format, you can often generate more ideas than by just creating lists. You can create mind maps by hand, using sticky notes, using presentation software such as Microsoft PowerPoint, or by using mind mapping software.

FIG. 2 shows a sample mind map for the SWOT analysis presented earlier. This diagram was created using MindView 4.0 Business Edition software by MatchWare.(See Section 5 and section C for more information; you can download a 60-day free trial of this software from matchware.com/itpm.) Notice that this map has four main branches representing strengths, weaknesses, opportunities, and threats. Ideas in each category are added to the appropriate branch, and sub-branches are shown for some ideas under those categories. Notice that several branches end with a project idea, such as Project proposal, Conference promotions, Accountant, Marketing plan, and Web site. You can easily format the project ideas to make them stand out, as shown in FIG. 2. From this example, you can see that no project ideas are identified to address strengths or threats, so these areas should be discussed further.

Identifying Potential Projects

The first step in project management is deciding what projects to do in the first place.

Therefore, project initiation starts with identifying potential projects, using realistic methods to select which projects to work on, and then formalizing their initiation by issuing some sort of project charter.

FIG. 2 Mind map of a SWOT analysis to help identify potential projects.

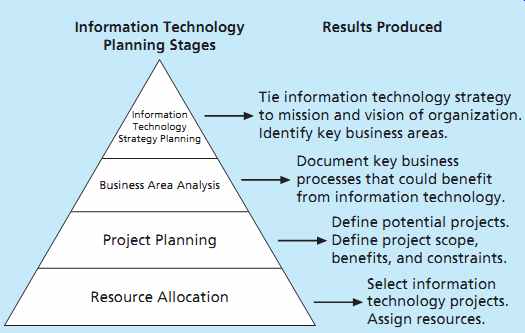

In addition to using a SWOT analysis, organizations often follow a detailed process for project selection. FIG. 3 shows a four-stage planning process for selecting IT projects. Note the hierarchical structure of this model and the results produced from each stage. The first step in this process, starting at the top of the hierarchy, is to tie the IT strategic plan to the organization's overall strategic plan. It is very important to have managers from outside the IT department assist in the IT planning process, as they can help IT personnel understand organizational strategies and identify the business areas that support them. Many organizations have a steering committee that consists of managers from departments throughout the company to ensure that all projects are selected in the best interests of the entire organization.

The head of the Project Management Office (PMO) would be part of this committee. The PMO acts as the central location for keeping track of all project activities. As you will learn later in this section, there are various methods for project and portfolio selection. Section 7, Project Cost Management, includes more information on project portfolio management.

After identifying strategic goals, the next step in the planning process for selecting IT projects is to perform a business area analysis. This analysis outlines business processes that are central to achieving strategic goals and helps determine which processes could most benefit from IT. The next step is to start defining potential IT projects in terms of their scope, benefits, and constraints. The last step in the planning process for selecting IT projects is choosing which projects to do and assigning resources for working on them.

Aligning IT with Business Strategy

Aligning IT projects with business strategy is consistently a top concern for CIOs. It is often difficult to educate line managers on technology's possibilities and limitations and keep IT professionals in tune with changing business needs. Most organizations face thou sands of problems and opportunities for improvement. Therefore, an organization's strategic plan should guide the IT project selection process. Recall from Section 2's Best Practice feature that IT governance is also important in ensuring that IT supports business goals. IT governance helps organizations maximize their investments in IT and address IT-related risks and opportunities.

An organization must develop a strategy for using IT to define how it will support the organization's objectives. This IT strategy must align with the organization's strategic plans. In fact, research shows that supporting explicit business objectives is the top reason cited for why organizations invest in IT projects. Other top criteria for investing in IT projects include supporting implicit business objectives and providing financial incentives, such as a good internal rate of return (IRR) or net present value (NPV).

FIG. 3 Planning process for selecting IT projects.

In a 2012 survey, responses from more than 300 IT executives suggested that investments that create revenue growth is a top priority (43 percent), followed by improving business processes (20 percent), enabling business innovation and expansion (19 percent), lowering business operation costs (13 percent), and lowering IT operations costs (3 percent).

Overall, the surveyed organizations reported a 4 percent increase in IT spending in 2012 from 2011.

Information systems often are central to business strategy. Author Michael Porter, who developed the concept of the strategic value of competitive advantage, has written several books and articles on strategic planning and competition. He and many other experts have emphasized the importance of using IT to support strategic plans and provide a competitive advantage. Many information systems are classified as "strategic" because they directly support key business strategies. For example, information systems can help an organization support a strategy of being a low-cost producer. As one of the largest retailers in the United States, Walmart's inventory control system is a classic example of such a system. Information systems can support a strategy of providing specialized products or services that set a company apart from others in the industry. Consider the classic example of Federal Express's introduction of online package tracking systems. FedEx was the first company to provide this type of service, which gave it a competitive advantage until others developed similar systems. Information systems can also support a strategy of selling to a particular market or occupying a specific product niche. Owens Corning developed a strategic information system that boosted the sales of its home-insulation products by providing its customers with a system for evaluating the energy efficiency of building designs. In 2012, the editor in chief of CIO Magazine stated, "The smart use of technology is always a key component in driving innovation and creating a competitive edge. We see IT value proving itself across the board in many organizations."

===========

BEST PRACTICE

Many organizations rely on effective new product development (NPD) to increase growth and profitability. However, according to Robert Cooper of McMaster University and the New Product Development Institute in Ontario, Canada, only one in seven product concepts comes to fruition. Companies such as Procter & Gamble, Johnson & Johnson, Hewlett-Packard, and Sony are consistently successful in NPD because they use a disciplined, systematic approach to NPD projects based on best practices. Four important forces behind NPD's success include the following:

1. A product innovation and technology strategy for the business

2. Resource commitment and focusing on the right projects, or solid portfolio management

3. An effective, flexible, and streamlined idea-to-launch process

4. The right climate and culture for innovation, true cross-functional teams, and senior management commitment to NPD

Cooper's study compared companies that were the best at performing NPD with those that were the worst. For example, 65.5 percent of companies that perform the best at NPD align projects with business strategy. Within the group of companies performing the worst at NPD, only 46 percent align projects with business strategy. Even more telling is that 65.5 percent of the best-performing NPD companies have their resource break downs aligned to business strategy, compared with only 8 percent of the worst performing companies. It's easy for a company to say that its projects are aligned with business strategy, but assigning its resources based on that strategy is a measurable action that produces results. The best-performing NPD companies are also more customer-focused in identifying new product ideas. Sixty-nine percent of them identify customer needs and problems based on customer input, compared with only 15 percent of the worst-performing companies. Also, 80 percent of best-performing companies have an identifiable NPD project manager, compared with only 50 percent of the worst performing companies.

These best practices apply to all projects: Align projects and resources with business strategy, focus on customer needs when identifying potential projects, and assign project managers to lead the projects.

===============

Methods for Selecting Projects

Organizations identify many potential projects as part of their strategic planning processes, and they often rely on experienced project managers to help them make project selection decisions. However, organizations need to narrow down the list of potential projects to the ones that will be of most benefit. Selecting projects is not an exact science, but it is a necessary part of project management. Many methods exist for selecting projects. Five common techniques are:

• Focusing on broad organizational needs

• Categorizing IT projects

• Performing net present value or other financial analyses

• Using a weighted scoring model

• Implementing a balanced scorecard

In practice, many organizations use a combination of these approaches to select projects. Each approach has advantages and disadvantages, and it is up to management to determine the best approach for selecting projects based on their particular organization.

Focusing on Broad Organizational Needs

Top managers must focus on meeting their organizations' many needs when deciding what projects to undertake, when to undertake them, and to what level. Projects that address broad organizational needs are much more likely to be successful because they will be important to the organization. For example, a broad organizational need might be to improve safety, increase morale, provide better communications, or improve customer service. However, it is often difficult to provide a strong justification for many IT projects related to these broad organizational needs. For example, estimating the financial value of such projects is often impossible, but everyone agrees that they have a high value. As the old proverb says, "It is better to measure gold roughly than to count pennies precisely." One method for selecting projects based on broad organizational needs is to determine whether they first meet three important criteria: need, funding, and will. Do people in the organization agree that the project needs to be done? Does the organization have the desire and capacity to provide adequate funds to perform the project? Is there a strong will to make the project succeed? For example, many visionary CEOs can describe a broad need to improve certain aspects of their organizations, such as communications. Although they cannot specifically describe how to improve communications, they might allocate funds to projects that address this need. As projects progress, the organization must reevaluate the need, funding, and will for each project to determine if it should be continued, redefined, or terminated.

Categorizing IT Projects

Another method for selecting projects is based on various categorizations, such as the project's impetus, time window, and general priority. The impetus for a project is often to respond to a problem, an opportunity, or a directive.

• Problems are undesirable situations that prevent an organization from achieving its goals. These problems can be current or anticipated. For example, users of an information system may be having trouble logging on to the system or getting information in a timely manner because the system has reached its capacity. In response, the company could initiate a project to enhance the current system by adding more access lines or upgrading the hardware with a faster processor, more memory, or more storage space.

• Opportunities are chances to improve the organization. For example, the project described in the section's opening case involves creating a new product that can make or break the entire company.

• Directives are new requirements imposed by management, government, or some external influence. For example, many projects that involve medical technologies must meet rigorous government requirements.

Organizations select projects for any of these reasons. It is often easier to get approval and funding for projects that address problems or directives because the organization must respond to these categories to avoid hurting their business. Many problems and directives must be resolved quickly, but managers must also apply systems thinking and seek opportunities for improving the organization through IT projects.

Another categorization for IT projects is based on timing: How long will it take to complete a project and what is the deadline for completing it? For example, some potential projects must be finished within a specific time window; otherwise, they are no longer valid projects. Some projects can be completed very quickly-within a few weeks, days, or even minutes. Many organizations have an end-user support function to handle very small projects that can be completed quickly. However, even though many IT projects can be completed quickly, it is still important to prioritize them.

Organizations can also categorize IT projects as having high, medium, or low priority based on the current business environment. For example, if it is crucial to cut operating costs quickly, projects that have the most potential to do so would be given a high priority.

An organization should always complete high-priority projects first, even if a low- or medium-priority project could be finished in less time. Usually an organization has many more potential IT projects than it can undertake at one time, so it is crucial to work on the most important projects first.

Performing Net Present Value Analysis, Return on Investment, and Payback Analysis Financial considerations are often an important aspect of the project selection process, especially during tough economic times. As authors Dennis Cohen and Robert Graham put it, "Projects are never ends in themselves. Financially they are always a means to an end, cash."

Many organizations require an approved business case before pursuing projects, and financial projections are a critical component of the business case. (See Section 3 for a sample business case.) Three primary methods for projecting the financial value of projects include net present value analysis, return on investment, and payback analysis.

Because project managers often deal with business executives, they must understand how to speak business language, which often boils down to the following important financial concepts.

Net Present Value Analysis

Everyone knows that a dollar earned today is worth more than a dollar earned five years from now. Net present value (NPV) analysis is a method of calculating the expected net monetary gain or loss from a project by discounting all expected future cash inflows and outflows to the present point in time. An organization should consider only projects with a positive NPV if financial value is a key criterion for project selection. A positive NPV means that the return from a project exceeds the cost of capital-the return available by investing the capital elsewhere. Projects with higher NPVs are preferred to projects with lower NPVs, if all other factors are equal.

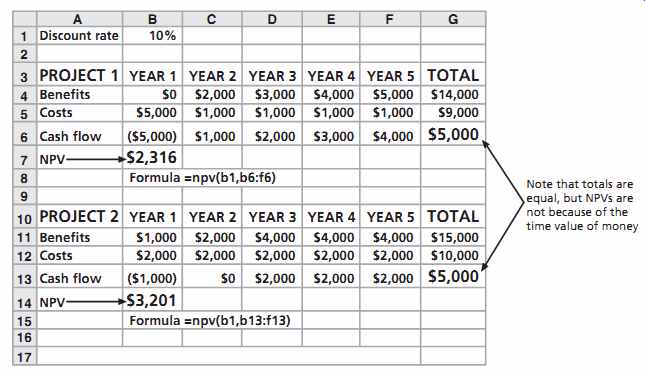

FIG. 4 illustrates this concept for two different projects. Note that this example starts discounting immediately in Year 1 and uses a 10 percent discount rate. You can use the NPV function in Microsoft Excel to calculate the NPV quickly. Detailed steps for per forming this calculation manually are provided later in this section. Note that FIG. 4 lists the projected benefits first, followed by the costs, and then the calculated cash flow amount. Note that the sum of the cash flow--benefits minus costs or income minus expenses--is the same for both projects at $5,000. The net present values are different, however, because they account for the time value of money. Project 1 has a negative cash flow of $5,000 in the first year, while Project 2 has a negative cash flow of only $1,000 in the first year. Although both projects have the same total cash flows without discounting, they are not of comparable financial value. Project 2's NPV of $3,201 is better than Project 1's NPV of $2,316. NPV analysis, therefore, is a method for making equal comparisons between cash flows for multi-year projects.

FIG. 4 Net present value example

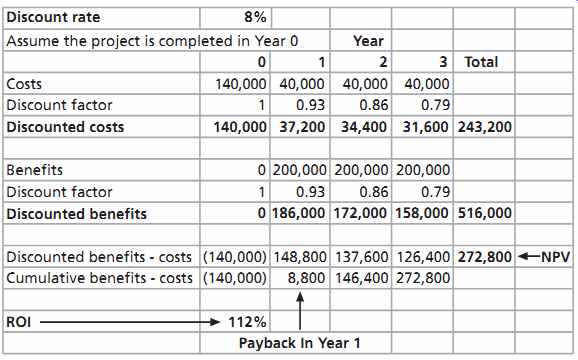

When calculating NPV, some organizations refer to the investment year or years for project costs as Year 0, and do not discount costs in Year 0. Other organizations start discounting immediately based on their financial procedures; it's simply a matter of preference for the organization. The discount rate can also vary, often based on the prime rate and other economic considerations. Financial experts in your organization can tell you what discount rate to use; some people consider it to be the rate at which you could borrow money for the project. You can enter costs as negative numbers instead of positive numbers, and you can list costs first and then benefits. For example, FIG. 5 shows the financial calculations that JWD Consulting provided in the business case for the project management intranet site project described in Section 3. Note that the discount rate is 8 percent, costs are not discounted right away (note the Year 0), the discount factors are rounded to two decimal places, costs are listed first, and costs are entered as positive numbers. The NPV and other calculations are the same; only the format is different. A project manager checks with the organization to learn its guidelines for when discounting starts, what discount rate to use, and what format the organization prefers.

FIG. 5 JWD Consulting net present value example

To determine NPV, follow these steps:

1. Determine the estimated costs and benefits for the life of the project and the products it creates. For example, JWD Consulting assumed its project would produce a system in about six months that would be used for three years, so costs are included in Year 0, when the system is developed, and ongoing system costs and projected benefits are included for Years 1, 2, and 3.

2. Determine the discount rate, which is the rate used in discounting future cash flow. It is also called the capitalization rate or opportunity cost of capital. In FIG. 4, the discount rate is 10 percent per year, and in FIG. 5, the discount rate is 8 percent per year.

3. Calculate the net present value. Most spreadsheet software has a built-in function to calculate NPV. For example, FIG. 4 shows the formula that Microsoft Excel uses: =npv(discount rate, range of cash flows), where the discount rate is in cell B1 and the range of cash flows for Project 1 are in cells B6 through F6. (See Section 7, Project Cost Management, for more information on cash flow and other cost-related terms.) To use the NPV function, you must have a row or column in the spreadsheet for the cash flow each year, which is the benefit amount for that year minus the cost amount. The result of the formula yields an NPV of $2,316 for Project 1 and $3,201 for Project 2.

Because both projects have positive NPVs, they are good candidates for selection. However, because Project 2 has an NPV that is 38 percent higher than Project 1, it would be the better choice. If the two numbers are close, then other methods should be used to help decide which project to select.

The mathematical formula for calculating NPV is:

NPV = t=0…:n At/1 ) r) t

...where t equals the year of the cash flow, n is the last year of the cash flow, A is the amount of cash flow each year, and r is the discount rate. If you cannot enter the data into spreadsheet software, you can perform the calculations by hand or with a calculator.

First, determine the annual discount factor-a multiplier for each year based on the discount rate and year-and then apply it to the costs and benefits for each year. The formula for the discount factor is 1/(1 ) r)t, where r is the discount rate, such as 8 percent, and t is the year. For example, the discount factors used in FIG. 5 are calculated as follows:

Year 0: discount factor = 1/1 ( 0:08)^0 = 1

Year 1: discount factor = 1/1 ( 0:08)^1 = .93

Year 2: discount factor = 1/1 ( 0:08)^2 = .86

Year 3: discount factor = 1/1 ( 0:08)^3 = .79

After determining the discount factor each year, multiply the costs and benefits each year by the appropriate discount factor. For example, in FIG. 5, the discounted cost for Year 1 is $40,000 * .93 = $37,200. Next, sum all of the discounted costs and benefits each year to get a total. For example, the total discounted costs in FIG. 5 are $243,200. To calculate the NPV, take the total discounted benefits and subtract the total discounted costs. In this example, the NPV is $516,000 - $243,200 = $272,800.

Return on Investment

Another important financial consideration is return on investment. Return on investment (ROI) is the result of subtracting the project costs from the benefits and then dividing by the costs. For example, if you invest $100 today and next year it is worth $110, your ROI is ($110 - 100)/100 or 0.10 (10 percent). Note that the ROI is always a percentage. It can be positive or negative. It is best to consider discounted costs and benefits for multi-year projects when calculating ROI. FIG. 5 shows an ROI of 112 percent, which you calculate as follows:

ROI /total discounted benefits- total discounted costs )=discounted costs ROI /516;000 - 243;200)=243;200 = 112%

The higher the ROI is, the better. An ROI of 112 percent is outstanding. Many organizations have a required rate of return for projects. The required rate of return is the minimum acceptable rate of return on an investment. For example, an organization might have a required rate of return of at least 10 percent for projects. The organization bases the required rate of return on what it could expect to receive elsewhere for an investment of comparable risk. You can also determine a project's internal rate of return (IRR) by finding what discount rate results in an NPV of zero for the project. You can use the Goal Seek function in Excel to determine the IRR quickly; for more information use Excel's Help function. Simply set the cell that contains the NPV calculation to zero while changing the cell that contains the discount rate. For example, in FIG. 4, you could set cell b7 to zero while changing cell b1 to find that the IRR for Project 1 is 27 percent.

Many organizations use ROI in the project selection process. In a recent Information Week study, more than 82 percent of IT decisions required an ROI analysis.

Payback Analysis

Payback analysis is another important financial tool when selecting projects. Payback period is the amount of time it will take to recoup the total dollars invested in a project, in terms of net cash inflows. In other words, payback analysis determines how much time will elapse before accrued benefits overtake accrued and continuing costs. Payback occurs when the net cumulative benefits equal the net cumulative costs, or when the net cumulative benefits minus costs equal zero. FIG. 6 shows how to find the payback period.

The cumulative benefits minus costs for Year 0 are ($140,000). Adding that number to the discounted benefits minus costs for Year 1 results in $8,800. Because that number is positive, the payback occurs in Year 1.

Creating a chart helps illustrate more precisely when the payback period occurs.

FIG. 6 charts the cumulative discounted costs and cumulative discounted benefits each year using the numbers from FIG. 5. Note that the lines cross around Year 1. This is the point where the cumulative discounted benefits equal the cumulative discounted costs, so that the cumulative discounted benefits minus costs are zero. Beyond this point, discounted benefits exceed discounted costs and the project shows a profit. Because this project started in Year 0, a payback in Year 1 actually means the project reached payback in its second year. The cumulative discounted benefits and costs are equal to zero where the lines cross. An early payback period, such as in the first or second year, is normally considered very good.

Many organizations have recommendations for the length of the payback period of an investment. They might require all IT projects to have a payback period of less than two years or even one year, regardless of the estimated NPV or ROI. Dan Hoover, vice president and area director of Ciber Inc., an international systems integration consultancy, suggests that organizations, especially small firms, should focus on payback period when making IT investment decisions. "If your costs are recovered in the first year," Hoover said, "the project is worthy of serious consideration, especially if the benefits are high. If the payback period is more than a year, it may be best to look elsewhere." However, organizations must also consider long-range goals when making technology investments. Many crucial projects cannot achieve a payback so quickly or be completed in such a short time period.

To aid in project selection, project managers must understand the organization's financial expectations for projects. Top management must also understand the limitations of financial estimates, particularly for IT projects. For example, it is very difficult to develop good estimates of projected costs and benefits for IT projects. You will learn more about estimating costs and benefits in Section 7, Project Cost Management.

Using a Weighted Scoring Model

A weighted scoring model is a tool that provides a systematic process for selecting projects based on many criteria. These criteria can include factors such as meeting broad organizational needs; addressing problems, opportunities, or directives; the amount of time needed to complete the project; the overall priority of the project; and projected financial performance of the project.

The first step in creating a weighted scoring model is to identify criteria that are important to the project selection process. It often takes time to develop and reach agreement on these criteria. Holding facilitated brainstorming sessions or using groupware to exchange ideas can aid in developing these criteria. Possible criteria for IT projects include:

• Supports key business objectives

• Has strong internal sponsor

• Has strong customer support

• Uses realistic level of technology

• Can be implemented in one year or less

• Provides positive NPV

• Has low risk in meeting scope, time, and cost goals

Next, you assign a weight to each criterion based on its importance to the project.

FIG. 7 Sample weighted scoring model for project selection

Once again, determining weights requires consultation and final agreement. You can assign weights based on percentages; the weights of the criteria must total 100 percent. You then assign numerical scores to each criterion (for example, 0 to 100) for each project. The scores indicate how much each project meets each criterion. At this point, you can use a spreadsheet application to create a matrix of projects, criteria, weights, and scores.

FIG. 7 provides an example of a weighted scoring model to evaluate four different projects. After assigning weights for the criteria and scores for each project, you calculate a weighted score for each project by multiplying the weight for each criterion by its score and adding the resulting values.

For example, you calculate the weighted score for Project 1 in FIG. 7 as:

25% x 90+ 15% x 70 +15% x 50+10%x 25+ 5% x 20 + 20% x 50+ 10% x 20 = 56

Note that in this example, Project 2 would be the obvious choice for selection because it has the highest weighted score. Creating a bar chart to graph the weighted scores for each project allows you to see the results at a glance. If you create the weighted scoring model in a spreadsheet, you can enter the data, create and copy formulas, and perform a "what-if" analysis. For example, suppose that you want to change the weights for the criteria. By having the weighted scoring model in a spreadsheet, you can easily change the weights to update the weighted scores and charts automatically. This capability allows you to investigate various options for different stakeholders quickly. Ideally, the result should reflect the group's consensus, and any major disagreements should be documented.

Teachers often use a weighted scoring model to determine grades. For example, sup pose that grades for a class are based on two homework assignments and two exams. To calculate final grades, the teacher would assign a weight to each of these items. Suppose Homework One is worth 10 percent of the grade, Homework Two is worth 20 percent, Test One is worth 20 percent, and Test Two is worth 50 percent. Students would want to do well on each of these items, but they should focus on performing well on Test Two because it is 50 percent of the grade.

You can also establish weights by assigning points. For example, a project might receive 10 points if it definitely supports key business objectives, 5 points if it somewhat supports them, and 0 points if it is totally unrelated to key business objectives. With a point model, you can simply add all the points to determine the best projects for selection, without having to multiply weights and scores and sum the results.

You can also determine minimum scores or thresholds for specific criteria in a weighted scoring model. For example, suppose that an organization should not consider a project if it does not score at least 50 out of 100 on every criterion. You can build this type of threshold into the weighted scoring model to reject projects that do not meet these minimum standards. As you can see, weighted scoring models can aid in project selection decisions.