INTRODUCTION

Internationally successful companies have identified the importance of logistics as a management function. Public awareness of logistics has increased significantly, and its influence on strategic corporate decisions is strong. However, many companies are still in the process of defining the specific scope of responsibility for their logistics function and gearing their service networks towards the needs of their customers.

Reduced delivery times and adherence to defined delivery dates as well as completeness and accuracy of delivery are important criteria for increasing customer satisfaction through logistics services.

At the same time, worldwide megatrends such as internationalization of procurement, production and sales, increasing resource scarcity and energy costs are challenges for logistics managers and lead to new and changing requirements on the network competence of companies. As a result, overriding macroeconomic and social trends have an ongoing effect on the development of logistics. More than ever before, today's logistics managers are confronted with dynamic trends in corporate development, and dynamic trends are difficult to forecast. Future-oriented strategies must be able to adapt to nascent trends as early as possible, and logistics goals must be geared towards these trends. This is the only way to ensure the long-term success of a company. Besides globalization, other major logistics challenges are continuously arising, especially in the form of internationalization, increased security requirements and an increasing demand for ecological sustainability. Within the framework of this section, we discuss the evolution of megatrends in general and analyze the effects of three identified megatrends on logistics and supply chain management.

TREND RESEARCH

A challenging market environment paired with modern information and communication technology as well as continuously increasing global link ages and dependencies of economic systems lead to higher dynamics on enterprise levels. In addition, the increasing complexity of value chain systems makes future developments appear more uncertain than ever before.

Accordingly, companies are constrained to react to these constantly changing influences. Studying the past in order to make a future projection is suitable only to a limited extent. Rather, early detection of emerging developments and their influencing factors as well as anticipatory estimation of possible impacts is required.

Logistics in particular has been subjected to extensive change in the past four decades in order to meet the changing requirements and influences. This process is not yet complete, and in the future logistics will assume more tasks that go beyond its current scope. To face these changes in an efficient way and to stay competitive, future developments have to be forecast and understood. Then strategies can be adjusted to allow for and take advantage of upcoming trends.

The expression 'trend' is not to be considered as a temporary fashion or short-term fad; rather it can be understood as the tendency towards substantial changes in economic and social structures and processes that will take effect in the near future. Core characteristics of trends are their duration and the scope of their effects. For duration, the shortest trend interval is a season. Assuming a certain stability in the development of trends, research is limited to five years of observation. The scope of their effect differentiates the sectors of our society in which changes show up.

Three types of trends can be distinguished:

social trends that describe cultural and social changes;

consumption trends that show the impact of social trends on goods and services;

industry trends that reveal developments within an industry sector.

Based on the combination of duration and scope, different types of trend can be outlined. 'Hype' is when the scope of effects increases in a very short time, followed by an equally fast decrease. In comparison, a 'niche trend' has changes that do not reach a certain threshold or advance beyond a defined range of scope. These can have varying intensity and continue for an extended period. 'Real' trends, however, achieve the trend threshold after a period of about five years and usually decline after a further two to three years.

Economic and social developments that have a significantly greater scope, on a global scale, and often much longer duration - perhaps more than decades - are described as megatrends. In general, they characterize a large, powerful, sustained and clear direction of future developments.

MEGATRENDS

Persisting long-term megatrends create particular challenges for logistics managers and result in increasing demands on their network skills. In the context of three studies conducted at the Berlin Institute of Technology, different megatrends with long-term influence on value-adding networks - and thus on logistics - were analyzed. In the following sub-sections, key results of the surveys into the megatrends of internationalization, security and ecological sustainability and their implications on logistics systems are considered in more detail.

Megatrend internationalization

The conditions for employment and execution of cross-border economic activities have improved significantly during the past century, and have led to an unprecedented amount of globally exchanged goods and globally dispersed value chains. Liberalization of markets, decreasing transportation costs and huge steps forward in information and communication technologies allow globally interconnected production systems - encouraging companies into a continuing process of internationalization to achieve growth in new markets and gain cost advantages in new locations.

In a rapidly changing environment, time is of major strategic importance for success when companies go global. On the one hand, companies need to manage the specific point in time when they penetrate a foreign market (particularly important in, for example, the current economic downturn), and on the other, the duration of the entire process of entering the foreign market is of decisive importance. In order to keep costs low, utilize assets as quickly as possible and implement business strategies, the internationalization process faces an enormous pressure on time.

----------

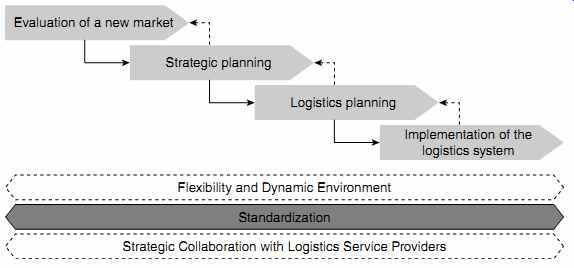

FIG. 1 Framework of the internationalization process

Evaluation of a new market Strategic planning Logistics planning Flexibility and Dynamic Environment Standardization

Strategic Collaboration with Logistics Service Providers Implementation of the logistics system

---------

In 1993 Miller suggested breaking internationalization down into a series of activities that gave access to foreign markets, with a framework that started with 'assessment' and finished with 'implementation'. Generally, all levels of decision making are integrated in such a process, starting with a top management strategic decision, handing over to middle management at a tactical level, and followed by operational tasks at the end. In practice, the internationalization process is more complex than this framework suggests and involves several business functions, and interdependencies are difficult to analyze. However, the simplification allows a structured and more detailed look at the different steps necessary for foreign market entry (as shown in FIG. 1).

The following findings are based on a study of internationalization of logistics systems that analyses how Chinese and German companies enter foreign markets:

1. Evaluation of a new market. This is triggered by the initial strategic idea of starting to work in a specific market or region. The internationalization process begins with comprehensive market analysis where top management evaluates the overall conditions in the target market. If the analysis shows that market entry is feasible and it is expected to meet the respective objectives, this first phase ends with the decision to enter the new market. Chinese and German respondents complete this step in between five and six months on average, meaning that this evaluation of the new market is the longest of all phases.

2. Strategic planning. Still at the top management level, in this phase foreign market entry is defined as a project, with a time schedule, defined milestones, budgets and concrete objectives for different corporate functions. The result of this phase is a framework that will guide the functional divisions of the company in developing their plans of action to achieve the strategic objectives of foreign market entry. Compared with the evaluation of the new market, this phase is much shorter. Chinese respondents calculate less than three months, Germans slightly more than four months.

3. Logistics planning. With close cooperation between all relevant functions, inbound, outbound and in-house logistics operations are defined and implementation plans are developed. Relevant topics in logistics planning include the definition of service levels, intended lead times, inventory policy, network structure, capacity calculation, allocation of facilities (such as warehouses and cross-docks), IT integration, decisions about logistics outsourcing, and preparation of tenders.

Chinese respondents stated that this phase accounts for nearly two months, German companies need slightly more than three months.

This phase has the shortest duration for both Chinese and German companies, which shows the tremendous time pressure under which these complex logistics structures are being planned.

4. Implementation of the logistics system. This is where managers find out whether their plans and decisions made in the early phases meet the requirements of the real world. The work in this phase is at an operational level and the organization must have comprehensive problem-solving skills, as unexpected occurrences and developments can raise a lot of unexpected difficulties. Owing to its complexity and the necessity for the success of internationalization, implementing the final logistics system is comparatively time-consuming, with 4.2 months at Chinese and 4.9 months at German companies.

Overall, Chinese companies indicate that the complete internationalization process lasts for approximately 14 months. German companies exceed that, with an average of almost 18 months.

The internationalization process addresses aspects of cross-functional as well as cross-company integration as a top-down process, from the initial idea to enter a foreign market to the closing implementation. The huge numbers of locations, intermediaries and suppliers involved in logistics networks, as well as customers working with different methods, procedures and conditions, always make global logistics a complex task.

One proven way of reducing complexity in this area is by standardizing processes. However, since different countries and regions have market specific conditions and requirements, logisticians need to balance globally standardized procedures with local adjustments to deal with the heterogeneity and complexity of international networks.

For an individual company the range of processes to be standardized differs according to its industry and business models. All kinds of inbound, in-house and outbound processes could be subject to standardization. One might think of boxes and pallets used to transport and store goods, order cycles and replenishment strategies, the application of milk runs and Kanban systems, production scheduling, the design and layout of cross-docks and warehouses, the use of Auto ID technologies etc.

In practice, standardized logistics processes are more or less equally widespread in all three sectors - industry, trade and services. In a study of trends and strategies in logistics, a survey found that a minority of 10 to 15 percent of companies currently operate without any standardized processes at all. By 2015, this figure will have fallen to between 3 and 8 percent across all sectors. Across all surveyed companies, the plans for the period up to 2015 indicate a particularly strong trend towards worldwide standardization. According to these findings, the share of industrial companies with worldwide logistics standards will increase from today's figure of 25 percent to 65 percent, while the increase in the trading sector will be from 25 percent today to 50 percent in 2015. This shows that a high percentage of the surveyed companies have recognized the relevance and potential of globally standardized logistics processes as a means of integrating existing locations .

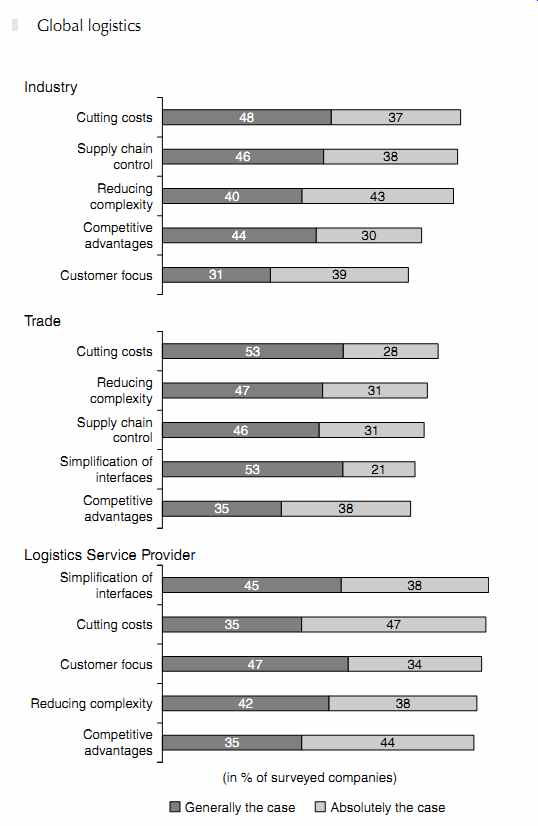

There are many reasons for the worldwide introduction of standardized processes - one factor that is of key significance in all sectors is the desire to cut costs and reduce complexity. Eighty-five percent of the surveyed industrial companies and 81 percent of their trading counterparts name cost reduction as the primary driver of global standards. In addition to reducing costs, 78 to 83 percent of companies believe that standardized logistics processes can also help to reduce complexity. Across all sectors, the focus of the surveyed companies is on the simplification or standardization of existing structures. In addition to reducing complexity and simplifying interfaces, 84 percent of industrial companies and 77 percent of trading companies name supply chain control as a further motive for the standardization of logistics processes (see FIG. 3).

In the endeavor to maximize the efficiency of logistics processes by standardization, however, each company must decide for itself whether it can employ standardized processes worldwide or to what extent it needs to adapt processes to local conditions. Successful companies often base their internationalization concept on a global strategy that they can adapt to local circumstances as and when needed - in line with the motto 'think global, act local'.

FIG. 2 Implementation of cross-plant standardization of logistics processes

FIG. 3 Top 5 reasons for the introduction of global standards

Megatrend security

Since the number of attacks against vehicles and logistical infrastructure has increased in recent years, a lot of attention has been paid to securing supply chains against terrorism: laws and regulations have been enacted, private initiatives like TAPA have been founded, standards have been established, new technologies have been developed and security management has been improved. Besides terrorism, supply chains have always been confronted with crime. Though many companies still consider supply chain security to be a cumbersome requirement imposed by legislation, other companies recognize that the provision of supply chain security can also be a step towards customer orientation and thus a competitive advantage.

A measured response to the worldwide security and risk situation and the ability to handle risks in an appropriate manner can be key factors in the success of modern companies. These risks include the threats posed by crime and terrorism as well as risks on the procurement or sales front.

Risks on the procurement and sales sides can be caused by such things as capacity bottlenecks in the procurement market, transport damage, a lack of transport and storage space or changes in consumer preferences. In addition, companies are also increasingly exposed to the risk of organized crime or terrorism, and this impacts the security situation in the logistics network.

The findings in the Trends and Strategies study on the impact of in creasing security requirements and risks in the logistics network on logistics activities show that around one in three respondents across all sectors already feel affected to a high or extremely high degree. The companies saying that these factors have little or very little effect on their logistics activities are still in the majority (between 38 and 43 percent, depending on sector), but this picture is expected to change in years to come. The percentage of companies that feel affected to a high or extremely high degree will increase by around 20 percent across all sectors up to the year 2015.

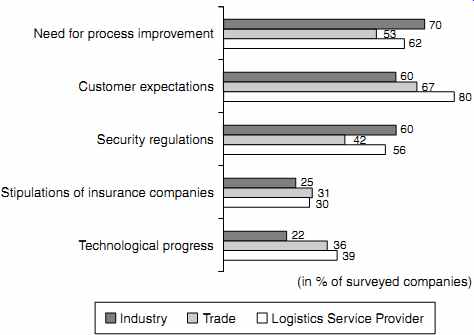

According to our respondents, the main drivers to gear their activities towards the issues of security and risk are the need to improve processes and the expectations of customers. The most important driver for industrial companies is the need to improve processes, while customer expectations are the key factor for the trading sector and logistics service providers. Eighty percent of service providers name customer expectations in their answer. The third main driver is security regulations, which impact the activities of industrial companies and service providers but play only a secondary role for the trading sector (see FIG. 4).

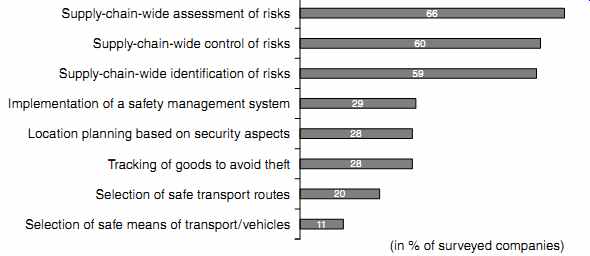

While laws, regulations or norms make high demands on companies, there is often a lack of practicable tools, concepts and research findings that would enable companies to increase security and tackle risks under their own steam. Up to one in three surveyed companies lack knowledge in the areas of security (when it comes to choosing safe transport routes and means of transport, for example), shipment tracking, location planning and security management. There is still a great deal of untapped research potential in the field of risk management. There is a lack of practicable tools and concepts, particularly for cross-company supply-chain-wide identification, assessment and control of risks. One of the key challenges in this respect is the assessment of the probability and damaging impact of potential risks in the supply chain (see FIG. 5).

-----------------

FIG. 4 Main drivers for implementing security and risk issues Need

for process improvement Customer expectations Security regulations Stipulations

of insurance companies Technological progress

---------

FIG. 5 Lack of tools and concepts

Supply-chain-wide assessment of risks Supply-chain-wide control of risks Supply-chain-wide identification of risks Implementation of a safety management system Location planning based on security aspects Tracking of goods to avoid theft Selection of safe transport routes Selection of safe means of transport/vehicles

---------

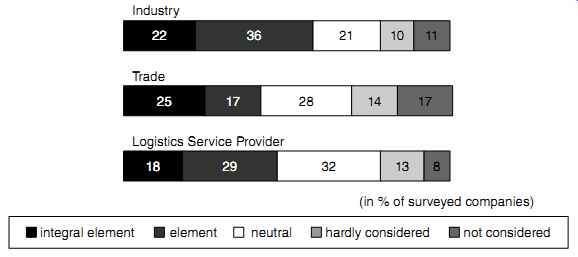

FIG. 6 Strategic integration of security and risk aspects

---------

Alongside the development of suitable tools, successful handling of risks in logistics networks also depends on cooperation between the companies in a logistics network. The precondition is the kind of mutual trust that ensures a uniform understanding of risks and adequate transparency of processes within the network. This in turn can improve security.

Successful integration of a security and risk management system is only possible if this system is firmly integrated from a strategic and organizational point of view. Security and risk aspects are incorporated in the logistics strategy of many companies. Service providers in particular (58 percent) describe these topics as part or even an integral part of their logistics strategy. Only 21 percent say that security and risk play little or no role in their strategy. The integration of security and risk aspects in the logistics strategy is also fairly common in industry (47 percent) and in the trading sector (42 percent), even if this is not something the majority of companies do. In industry as well, 21 percent of companies say that these aspects play little or no role in their logistics strategy, compared to 31 percent in the trading sector (see FIG. 6). This underlines the fact that companies recognize the strategic importance of the topic and assign responsibility for this topic to an appropriate organizational level. The entire company is exposed to security threats and risks, and these risks need to be addressed holistically.

Megatrend ecological sustainability Owing to climate change, increasing environmental destruction and the depletion of natural resources, an enhanced public awareness of protecting the environment and natural resources is noticeable. Thus, the ecological pressure on companies is growing. Companies are exposed to meeting the demand of internal and external stakeholders to operate economically and ecologically. Companies are asked to create and offer sustainable products and services, with this demand getting more and more important owing to different stakeholders. Therefore, the challenging objective is to analyze the life cycle of products and their entire value chain from an environmentally sustainable point of view and to meet customer requirements at the same time.

5 Rising customer demands for ecological products and services, increasing global regulations (e.g. CO2 trade), rising resource prices (e.g. oil) and the demand for more corporate social responsibility are the four main drivers for environmental and resource protection within companies. The implementation of ecological sustainability affects almost every unit of a company, especially logistics and supply chain management. An essential requirement for logistics, for example, is the reduction of greenhouse gases. It is estimated that today, up to 75 percent of a company's carbon footprint, i.e. CO2 emissions, results from transportation and logistics.

Hence, logistics needs to highlight the current need for 'green' solutions.

In the following, the relevance and fields of action for companies for ecological sustainability in logistics will be discussed in more detail. This will convey the potential of optimization and spheres of activity. The results are based on the Global Logistics 2015+ study.

Relevance for companies

Global Logistics 2015+ reveals that environmentally compatible logistics is a relevant issue but has not yet reached the status of a top priority for many companies.

The majority of the sample (60 percent) expect that an absence of green logistics by 2015 may even lead to financially tangible disadvantages. However, interviews revealed that most companies have just begun to put a focus on the greenness of their logistics. The first steps in a green logistics direction were taken (e.g. reduction in / avoidance of transport and energy) - however, these are rather generic objectives applying only to a particular 'environmental issue'. The majority of the companies have no concrete goals, measures or holistic approaches in order to achieve ecologically sustainable solutions for logistics processes.

This is often caused by a shortage of standards, tools and methods, leaving respondents to wait for concrete legal requirements and guidance (for, say, CO2 emissions). The exact impact of logistics systems on the environment is largely unknown. In the study, 70 percent of the participants identified a need for tools that measure the overall environmental impact of logistics. Existing tools and methods are sometimes not known or not fully deployable in practice.

Regarding the financing of such projects or green logistics in general, it was determined that in most cases only very limited or no budgets were available. Passing on additional costs to the end customers is not considered a viable option. Only 16 percent of the respondents believe that their customers display willingness to spend extra money for environmentally compatible products or services.

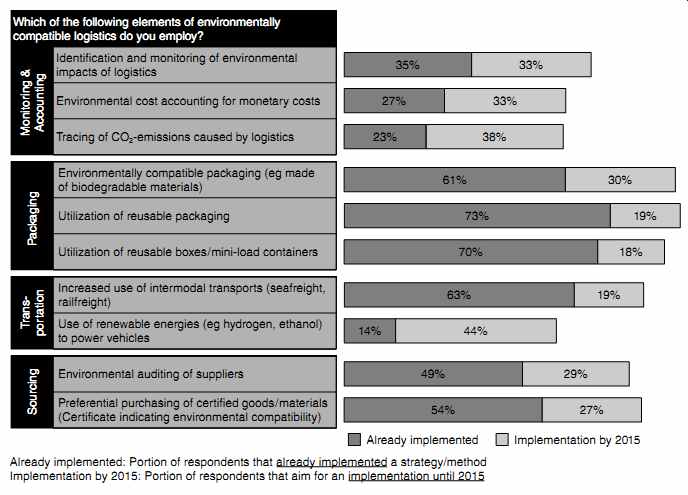

FIG. 7 Fields of growth for ecologically sustainable logistics

The status quo and fields of action for ecological sustainability in logistics

Some approaches to implementing environmental compatible logistics systems display remarkable growth in the future. Many companies are planning to implement these approaches by 2015. The fields of growth are:

Transportation and packaging. An environmentally friendly design for transportation and packaging has been regarded as the highest priority for companies in order to achieve green logistics. Considering transportation, an increase of efficiency can be generated in the short term, for example by improving capacity utilization and avoiding empty runs (e.g. through bundling and route planning wherever possible). Furthermore, 19 percent of the sample want to utilize intermodal transportation and 44 percent plan to increase the use of renewable energy sources in their vehicle fleets. The majority of participants aim to realize a twofold benefit, since both higher capacity utilization and a reduction in the level of transport activity lead to a reduction in environmental pollution and also a reduction in costs.

Companies take various steps towards designing less environmentally harmful packaging. Some companies are specifically applying reusable boxes and containers. However, interviewees did point out that for long-distance transport they need to evaluate whether the ecological and economic effects actually necessitate or even legitimate their use of reusable boxes and containers. Furthermore, the recycling of packaging materials (e.g. biodegradable materials) was frequently mentioned as a means to increase environmental compatibility.

Environmentally friendly sourcing. Achieving 'greener' business in many cases also includes the involvement of partners. One trend is environmental sourcing, where companies seek to audit their suppliers' greenness or preferably purchase goods certified for their environmental compatibility. Interviewees even stated that they would consider terminating business relationships as a result of inferior environmental compatibility of their suppliers or their products. However, in many cases interviewees would generally be willing to support their suppliers in the search for solutions in the case of poor results in environmental audits. Ultimately, this reveals another important driver for companies' (and suppliers') environmentally friendly behavior.

--------------

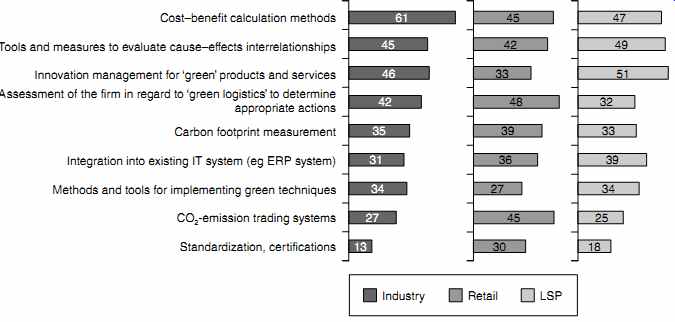

FIG. 8 Lack of tools and concepts

Cost-benefit calculation methods Tools and measures to evaluate cause-effects interrelationships Innovation management for 'green' products and services Assessment of the firm in regard to 'green logistics' to determine appropriate actions Carbon footprint measurement Integration into existing IT system (e.g. ERP system) Methods and tools for implementing green techniques CO2-emission trading systems Standardization, certifications

-----------------

Involvement and cooperation with logistics service providers (LSPs). LSPs will also play an important role in achieving environmentally compatible logistics. Since companies have almost fully outsourced transportation and major portions of warehousing in many cases, these companies particularly demand LSPs' involvement in their green efforts and require LSPs to ecologically improve their existing logistics services.

Forty-five percent state that they already take LSPs' greenness into consideration upon selection during tenders. This is achieved by demanding certifications and standards (e.g. ISO, EU emission standards). However, only 23 percent of the sample are able or willing to spend extra money to employ greener transport. Environmentally friendly transport cannot be established at the expense of the service level since only 12 percent consider lower service levels (e.g. longer lead times or less frequent deliveries) acceptable in exchange for more environmentally friendly operations. Thus, LSPs are asked to improve the environmental compatibility of their services while leaving service and cost levels unchanged. By 2015, approximately 45 percent of the respondents will contract third parties to manage environmental issues. It is still not clearly predictable to what extent LSPs will take over this task, although it is clear that LSPs will consult their customers when designing environmentally compatible logistics on the operational, tactical and strategic level.

Measurement and evaluation. As mentioned earlier, many companies have not yet determined the level of environmental compatibility of their logistics. Thus, identification of drivers, measurement of greenness and evaluation of environmental impact are important steps towards the development of sustainable logistics. By taking into account all activities for achieving environmentally compatible logistics, the measurement and evaluation of environmental impact (e.g. damage caused to health, damage caused to the environment, CO2 emissions and monetary costs) will increase most. The Trends and Strategies study intensively analyses the topic of measurement and evaluation.

The results underline the fact that there is an absence of suitable tools, concepts and research results across and throughout all three sectors (see FIG. 8).

It can be observed that there is a lack of strategic concepts that companies can use to determine their own positioning and sensitivity in order to arrive at tailored and effective courses of action. There is a lack of cost- benefit calculations to serve as a basis for these decisions. There is also a lack of integration and implementation concepts and tools that would facilitate efficient implementation. Finally, there is a lack of methods to measure the actual effect of in-house and cross-company logistics processes on the environment and on resources.

CONCLUSION AND OUTLOOK

Persisting long-term megatrends create challenges for logistics managers and result in increasing demands on the network skills of today's companies - due to ongoing globalization, security requirements, the need to protect the environment and spare resources and, last but not least, requirements relating to their business systems such as customer differentiated reliability, flexibility and cost-efficiency. Many logistics managers need an extended scope of customer-focused responsibility (end-to-end), stronger integration in corporate strategy and organizational structures, better operation of logistics goals, more transparency in the area of logistics costs and a stronger focus on innovative cross-company projects.

At present, many companies still focus their efforts on internal processes and operational goals. But the picture is different in different companies and also varies from sector to sector. The majority of companies have still not implemented holistic responsibility concepts for the customer-to customer process, and this is something that will require major effort. The trading sector has been successful with its end-to-end implementation concepts based on the idea of reverse integration and has therefore made more progress in some areas than many industrial companies.

The analyses in these studies show that very few surveyed companies have already attained a high level of logistics network maturity. When formulating their logistics goals, companies react to global challenges by prioritizing service-level-oriented logistics goals, which in some areas take precedence over cost goals. This applies above all to global and fragmented logistics networks with high outsourcing levels and qualities.

In future, cooperation in global networks will increasingly depend on how successful the various players are in identifying the key central trends and then integrating the resulting tasks in their value systems, strategies and operational logistics systems. The 'best' companies strategically integrate their logistics activities in the overall business system. They have recognized the benefits of logistics and can measure these benefits.

This means they are able to create a higher end-to-end scope of responsibility and to successfully complete strategic projects. As a result, they already achieve provable cost advantages by implementing successful outsourcing projects in a globalized corporate environment with the emphasis on sustainable solutions.

In doing so, they succeed in arriving at a holistic assessment of risks and opportunities throughout the entire network (end-to-end) and coordinating these risks and opportunities with their network partners, and this is ultimately what enables them to develop a focused network strategy. This strategy is based on, among other things, frequent use of horizontal cooperation models and a standardized network-wide assessment procedure for their suppliers and service providers.

Moreover, the 'best' are increasingly using supra-regional and cross border benchmarking systems on a regular basis - primarily to identify network-wide optimization potential. We assume that benchmarking in this area is not designed solely to allow comparisons but also serves as a management concept. This would mean that it would be justified to claim that the 'best' review and compare their logistics performance and skills on a regular basis. They use the resulting insights to identify best practices geared towards further optimization and adaptation - and then implement these practices globally.

top of page Home Similar Articles